Everything you need to know about reporting

to a Securitisation Repository under

the EU Securitisation Regulation

Introducing the Securitisation Regulation (EU) 2017/2402

The Securitisation Regulation (EU) 2017/2402 (SECR), which was published in the Official Journal of the EU on 28 December 2017, establishes a general framework for all securitisations and creates a more specific framework for simple, transparent and standardised (STS) securitisations.

The SECR has introduced new disclosure requirements for the originator, sponsor and / or Securitisation Special Purpose Entity, commonly known as Reporting Entities (RE). As per Article 7 of the SECR, the RE has to submit a number of transaction documents as well as data on the underlying exposures (UE), investor reports (IR) and inside information / significant events (II/SE).

For securitisations with a prospectus drawn up in compliance with the Prospectus Regulation (EU) 2017/1129 (PR), commonly referred to as public securitisations, these should also be made available by means of a Securitisation Repository (SR).

Complying with the Disclosure RTS via ESMA templates for Asset-Backed Commercial Paper (ABCP) and Non-ABCP

According to the Disclosure Regulatory Technical Standards (RTS), which entered into force on 23 September 2020, the information on UE, IR and II/SE should be made available using the following templates. The templates are available on the ESMA website and are listed below:

- UE: Annexes II – X (NABCP) / Annex XI (ABCP)

- IR: Annexes XII (NABCP) / XIII (ABCP)

- II/SE: Annexes XIV (NABCP) – XV (ABCP)

Further guidance on the disclosure templates is provided in the ESMA Q&A document on the ESMA website. This document is updated on a regular basis and includes Q&A on Securitisation topics.

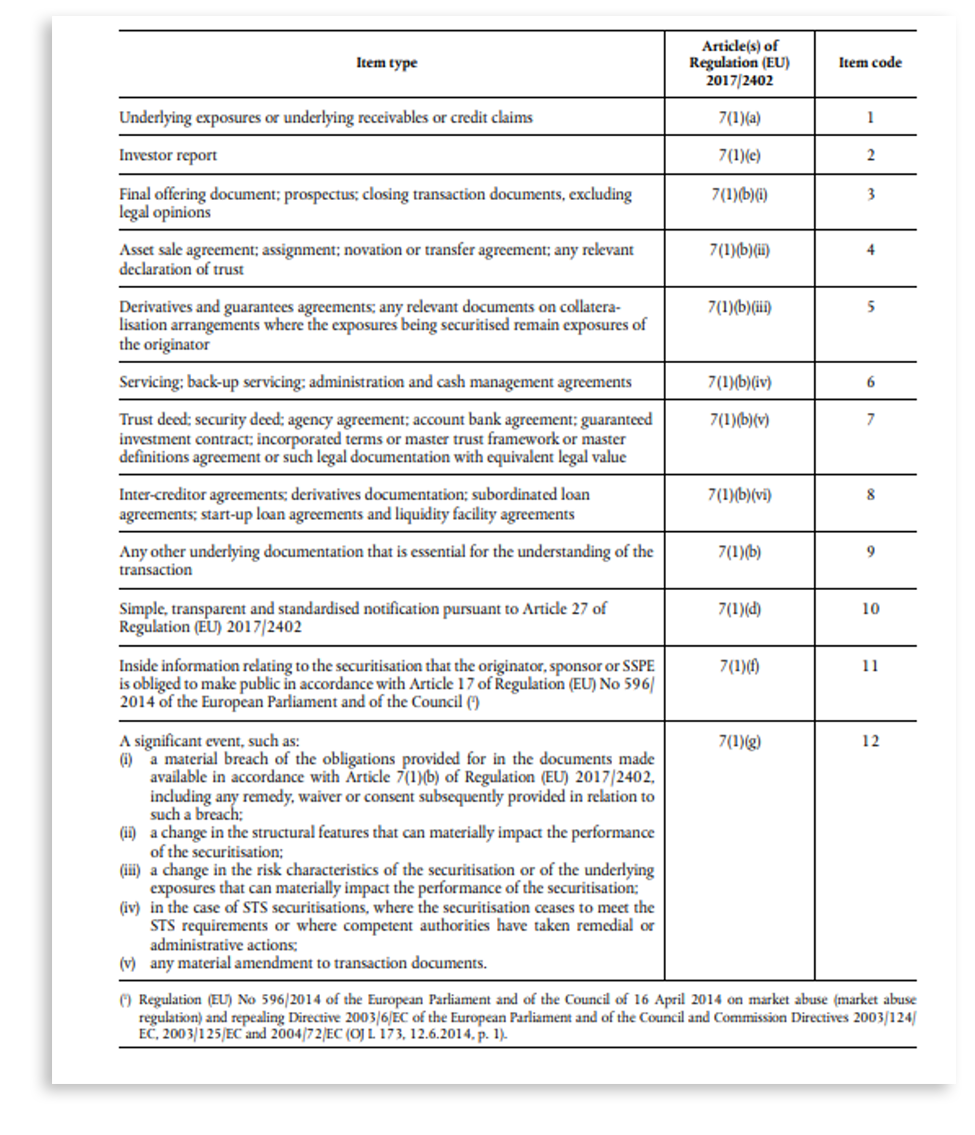

Unique Identifier and Item codes at a glance

The Disclosure RTS have also introduced a requirement for REs to assign a Unique Identifier for each securitisation in a prescribed format. Additionally, the RE should assign item codes for the reporting of the information to a SR. Please refer to the following table.

Information Timeliness and Reporting Frequency

With respect to the timeliness of the information, the data cut-off date for NABCP should be no later than two calendar months prior to the submission date. For ABCP the cut-off date should also be no later than two calendar months prior to the submission date for Annex XI and the transaction information section of Annexes XIII and XV. For all other sections, the data cut-off should be no later than one calendar month prior to the submission date.

As set out in the Article 7 (1) of the SECR, reporting frequency is expected at least quarterly for NABCP and no later than one month after the Interest Payment Date (IPD), and monthly for ABCP.

Navigating the Disclosure ITS and template formats

Based on the Disclosure Implementing Technical Standards (ITS), the format for providing the information should be in an electronic and machine-readable form via common XML (Extensible Markup Language) templates.

EDW understands that the preparation of the data in an XML format can be challenging and therefore has developed a CSV to XML Converter for this purpose. Once the file has been converted, users can download the new XML file along with an error log file providing detailed information about any data or conversion issues.

For more information on the converter please contact EDW at enquiries@eurodw.eu .

Reporting to a Securitisation Repository– The process explained.

Since 30 June 2021, five days following the registration of the first SRs by ESMA, REs are required to submit their information by means of a SR and adhere to the SR reporting requirements.

According to the reporting instructions available on the ESMA website, the following schematic representation is a high level description of the business processes and the various entities involved.

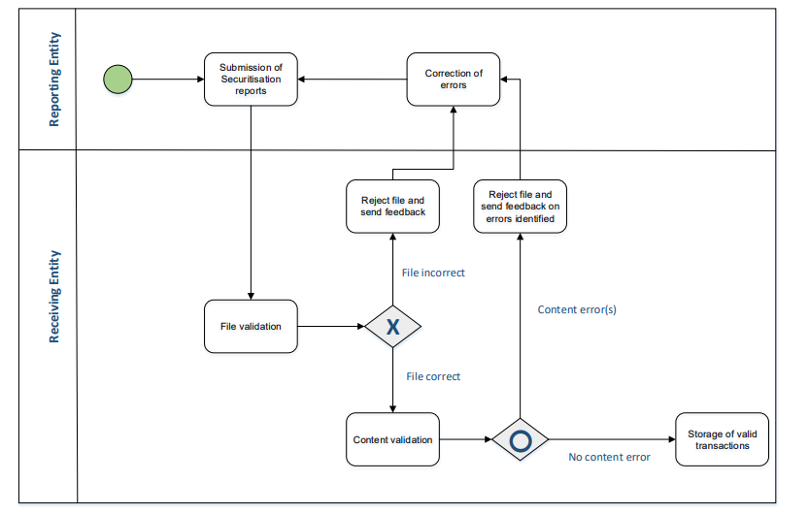

The reporting process is summarised in the following schematic representation:

Source: ESMA

The SR receives a submission of data (UE+IR+II/SE) from the RE – what comes next?

The first step is the file validation, whereby the SR validates that the information provided is in compliance with the structure and format of the XML schema. If the file format is correct, then the content validation takes place. During this content validation phase the SR runs a number of checks to verify the completeness and consistency of information as set out in the SR operational standards RTS. This includes the following:

i. Inter-field consistency checks – verify that the information across data fields of the same UE, IR and II/SE of the same data cut-off date is consistent

ii. Inter-templates consistency (same PCD) – verify that the same information across the UE, IR and II/SE of the same data cut-off date is consistent

iii. Inter-submission consistency – verify that the information for the same UE, IR and II/SE and different data cut-off dates is consistent

iv. Benchmarking across similar securitisations – compare data across similar securitisations

v. Timeliness check – verify that the data cut-off data is in compliance with the information timeliness set out in the Disclosure RTS

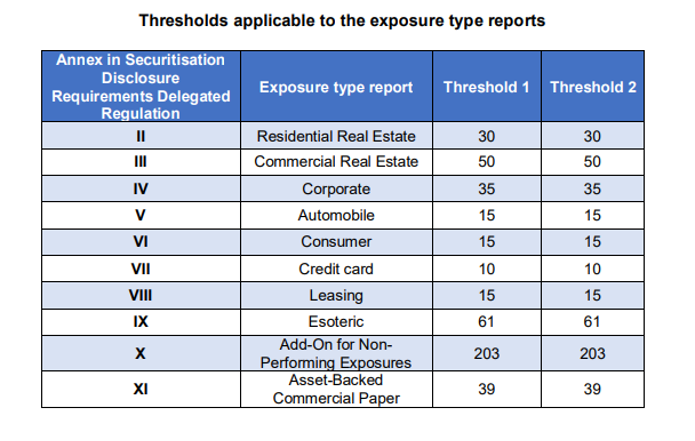

vi. No Data (ND) thresholds – check that the ND reported in the UE is within the permitted ND thresholds set out by ESMA in the Guidelines on securitisation repository data completeness and consistency thresholds.

Source: ESMA

File validation failure – what do to?

If, during the file validation phase, any of the files (UE, IR and/or II/SE) are incorrect then the submission is rejected by the SR and a feedback message is automatically generated, indicating the relevant schema errors identified.

An automatic feedback message is sent by the SR to the RE. Once the feedback message is received, the RE must then make the necessary corrections or adjustments to the respective files and re-submit the set of files (UE+IR+II/SE).

Troubleshooting content validation failure

For files that pass the content validation phase, a feedback message is generated by the SR notifying the RE of a successful submission. If any of the files contain content errors, the files are rejected and a relevant feedback message is sent to the RE indicating the content errors identified. The RE is then required to make the necessary corrections or adjustments to the information before re-submitting the set of files (UE+IR+II/SE). Please note: With regard to the verification and consistency checks (i-vi) described previously, only points i, ii, v and vi can lead to a file rejection. Points iii and iv would not result in a file rejection.

Demystifying the ESMA completeness score calculation

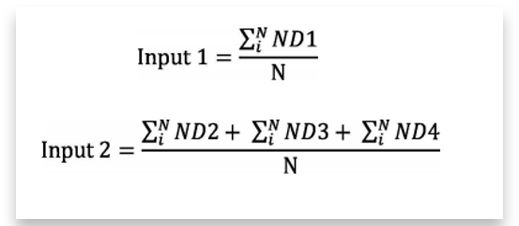

Following a successful submission to a SR, the SR should calculate a data completeness score for each submission. This is known as the ESMA score and is based on the following formula.

The SR calculates the number of ND values reported in a submission of UE+IR and assigns a score based on the ESMA scoring matrix available in the SR operational standards RTS. Please note that the II/SE do not allow any ND1-4 values and is therefore not considered in the scoring calculation.

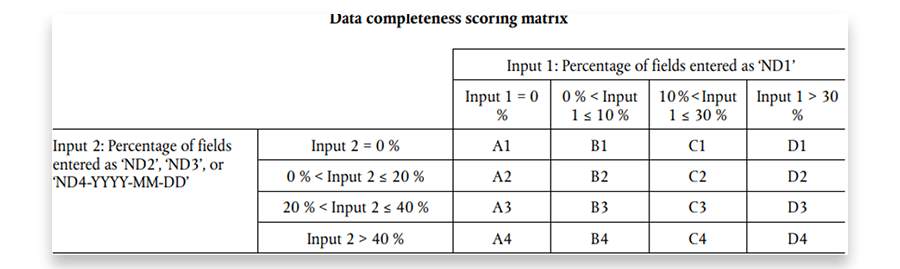

As per the SR operational standards RTS , the SR should reject a submission of information that is considered incomplete or inconsistent. For example, in the case of a file validation error (XML schema error) and/or a content error (i, ii, v and vi). For each submission rejected, the SR is required to assign one of the following rejection categories (see table below) and include it in the feedback message sent to the RE.

The following table includes the rejection categories and the reasons for rejection.

Submitting the written confirmation to verify completeness of documents

While there are ways to verify the consistency and completeness of XML templates provided to a SR, this is not the case with the documentation (e.g.Prospectus) submitted to the SR by the RE pursuant to Article 7 (1) b of the Securitisation Regulation. Therefore, the SR is obliged to request a written confirmation from the RE that all relevant documentation has been provided and is consistent with the features of the securitisation. There are certain timeframes outlined in the SR operational standards RTS, but most notably, the signed document should be provided within 14 calendar days of receiving a request from the SR.

There is no prescribed manner for the written confirmation, however, EDW has created a standard sample template that can be used for this purpose. The EDW template can be found here.

Detailed information about the written confirmation requirement can be found in this Special Reporting Guidelines article.

Reporting obligations by Securitisation Repositories

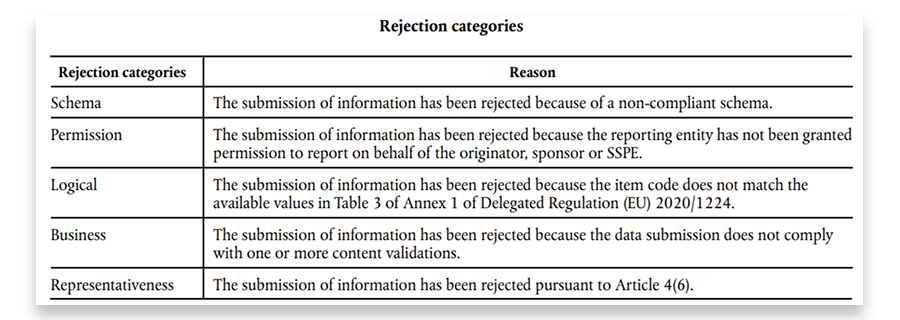

In addition to determining whether a submission is accepted or not, SRs are also required to generate the following two reports:

- End-of-Day Report

The SR should generate a daily End-of-Day Report with aggregate information on all the submissions reported to the SR, excluding rejected submissions. This report is available to all investors, ESMA, the Eurosystem, and other users under Article 17 (1) of the Securitisation Regulation.

More information about the contents of this report can be found in Article 2 of the SR operational standards RTS. - Rejection report

The SR should also generate a weekly Rejection Report with aggregate information about all the submissions that have been rejected in the previous week.

The following chart provides an overview of the two reports.

Source: ESMA

During the first half of 2021, EDW proudly launched its regulatory-compliant platform EDITOR in a Sandbox environment. REs were able to test their files, identify potential file structure and content errors in the new reporting templates, preparing them for the transition to the SR reporting requirements.

At EDW, our team of dedicated and multilingual data analysts will guide you through the reporting process and assist you with any technical and reporting related queries. Please contact us via enquiries@eurodw.eu or call us on +49 (0) 69 50986 9017.