EDW PUBLICATION INVENTORY: SHOWCASING LOAN-LEVEL INSIGHT BEYOND THE FIELD OF SECURITISATION

With over a decade of service to Europe’s securitisation market under its belt, European DataWarehouse has collected over three billion loan records across all asset classes since its inception in 2012.

Within those loan records lies a wealth of insight used predominantly in the asset-backed securities market for risk assessment and cash-flow modelling purposes. But, thanks to the available time series and detailed nature of the loan-level data, it is also valuable for studies beyond the field of securitisation.

Not only does EDW use this dataset for its own research, regularly publishing reports and blogs, but so do various academic institutions, national central banks, rating agencies, and other third parties.

EDW’s current Inventory of Publications lists 114 titles and includes a user-friendly overview of key characteristics such as the author(s), publisher, publication type, date, keywords, and link (where applicable).

Most of the listed publications are freely available either on the EDW website or via a third-party website; 101 out of 114 can be accessed directly. The other (restricted) publications are mostly rating agency publications available to subscribers only.

EDW DATA IN USE

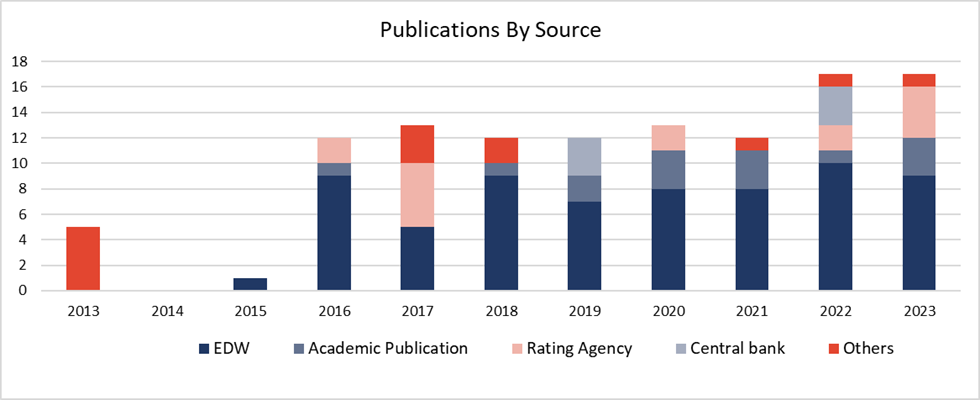

From the inventory, 66 publications have been produced by EDW and the remainder are “third party” publications, (Exhibit 1).

Exhibit 1: EDW Produced More Than Half of the Documents in the List

Source: European DataWarehouse

Rating agencies were early users of the EDW database, whilst academic publications have become more frequent since 2020.

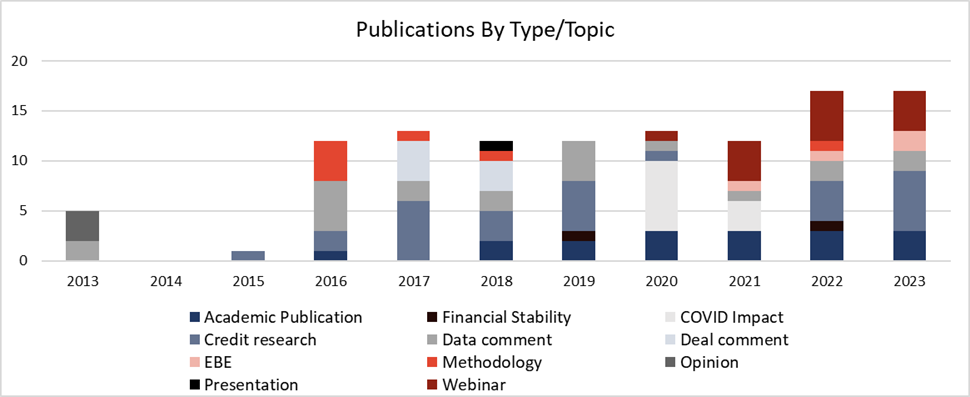

Exhibit 2 provides an overview of the publication type. The number of new publications per year remained consistent from 2016 to 2021, although the type of publication has changed somewhat over time:

-

There were more data comments and methodology-type reports from 2016 to 2019. These are almost all EDW documents intending to explain our dataset to data users.

-

Credit research using EDW data has regularly been published. These are mostly rating agency publications, but the list also includes our own SME and RMBS performance indices.

-

For the 2020-2021 period, our list includes ten COVID-related publications, mostly based on EDW research; these reports document the impact of COVID on securitisations in terms of delinquencies and moratoria.

Since 2021, EDW has hosted four research webinars per year, in which we discuss recent trends and see how they impact our dataset. The slides of these webinars (and sometimes a recording) are available in the Archived Events section of our Events webpage. We regularly invite data users to share their findings in our webinars.

Exhibit 2: Publication Type has Changed Over Time

Source: European DataWarehouse

Whilst almost all the publications in the list refer to EDW data or are based on EDW research, the European Benchmarking Exercise (EBE), a report on private securitisations (written in cooperation with TSI and AFME), is an exception. In this case, the 12 participating banks provide aggregated data specifically for the purpose of writing this report. Private loan-level data uploaded to the EDW database is therefore not used for the EBE.

LOAN-LEVEL DATA OFFERS INSIGHTS ACROSS A VARIETY OF AREAS

The loan-level data uploaded to EDW’s EDITOR platform has numerous use cases and can provide insight into many important areas of interest. For example, publications using EDW’s RMBS data addressed such topics as:

-

The role of the housing market in the transmission of monetary policy

-

The relation between energy efficiency and mortgage defaults

When it comes to the auto asset class, EDW data has also been used to address the following topics:

Other publications also refer to SME and Credit Card data, as well as data from multiple asset classes.

Although credit risk has always been a key topic for EDW data users, we note that ESG-related topics have attracted a lot of attention in recent years and EDW’s growing sustainability-related dataset is also being used for a number of ESG-related research activities.

EDW’s Inventory of Publications is unlikely to be complete and is continuously being updated as new content is published. We encourage our data users to advise of any additional publications that could be added to this list and shared with our network. Please email enquiries@eurodw.eu should you wish to share your work.

RESEARCH ARTICLES

Please contact enquiries@eurodw.eu if your publication references EDW data but is not yet available on our website.