COVID-19 in SME DATA

In late February, towns in the Lombardy region in Italy began going into lockdown, one after the other. Schools, restaurants, shops, and offices all shuttered in what seemed like an extreme measure to the rest of Europe. Within a matter of weeks, much of the world would find itself under similar restrictions.

Today we are still far from understanding both the virus and the impact it will ultimately have on all our lives as well as the global economy. While numerous measures have been swiftly implemented by both regional and national governments to mitigate financial fallout, the economic impact has already claimed countless jobs and businesses.

We have already begun to see evidence of COVID-19 in ED’s data set. That being said, we believe we will see a clearer indication of a shifting economy in the coming months, once we have gathered enough data to properly assess payment holidays, default rates, stagnant outstanding loan balances, and other indicators reported regularly in ED’s platform.

In order to fully imagine the impact COVID-19 on our data set, it is essential to first illustrate the exposure within our data. For the sake of this first blog in our series on COVID-19, we will evaluate the vulnerability of our data to Spanish and Italian SME loans. As two of the first countries in Europe to enter lockdown, we believe Italy and Spain may show evidence of COVID-19 earlier than other European countries. Furthermore, we believe Small and Medium Enterprises will be significantly impacted by the coronavirus, particularly those dependent on the movement and interaction of people, including Accommodation and Food Service Activities, and Retail.

SME DATA OVERVIEW

There are 59 active ABS transactions for the SME asset class in our platform from 7 countries, and the aggregate outstanding balance of their underlying loans stands at 83.6 Billion Euros.

Spain and Italy account for the highest number of transactions.

There are 38 active ABS transactions for the SME asset class in our platform from Italy and Spain. The aggregate outstanding balance of their underlying loans stands at 38.7 Billion Euros.

COUNTRY-LEVEL

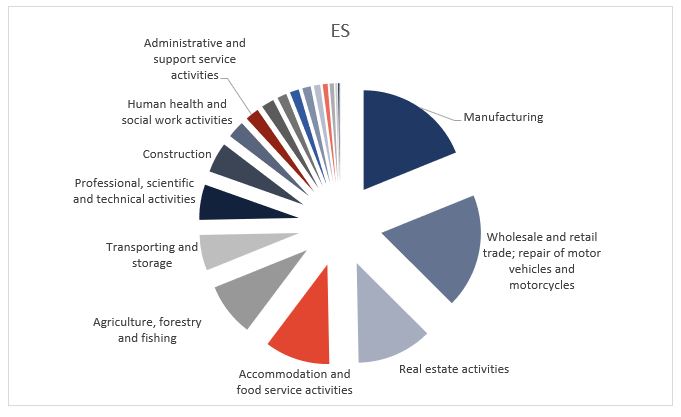

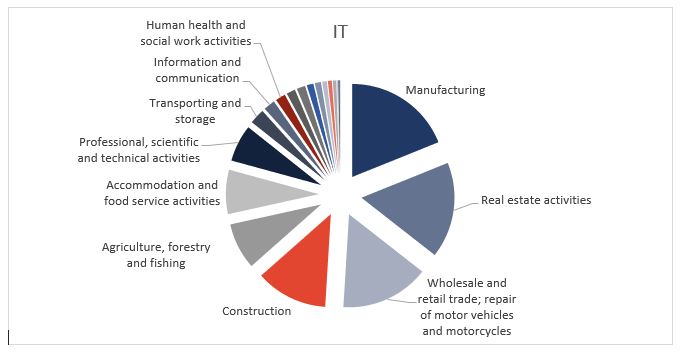

The overall exposure of the underlying loans from Spain and Italy is similar, with the Manufacturing sector taking the highest share for both regions, followed by Real Estate and Wholesale/Retail trade. It is important to note that these industries account for more than half of the share for each country. The remaining share for the two countries seems mostly similar, except for the Construction industry, which is significantly higher in Italy (IT: 13%, ES: 5%).

We understand that COVID-19 will have a particularly high impact on some industries more than others. Exposure to highly sensitive sectors, such as Accommodation and Food Service Activities, could correlate to deteriorating performance in the future.

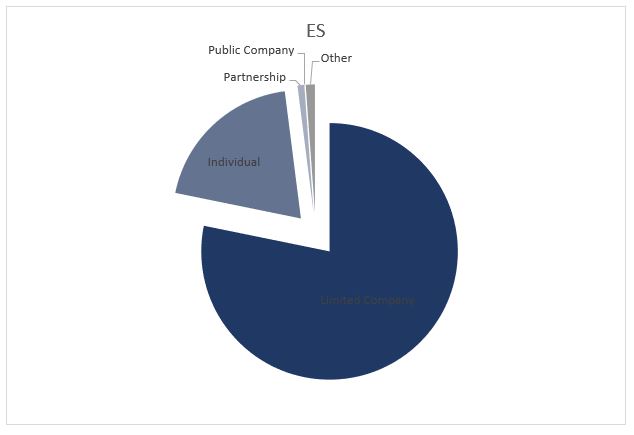

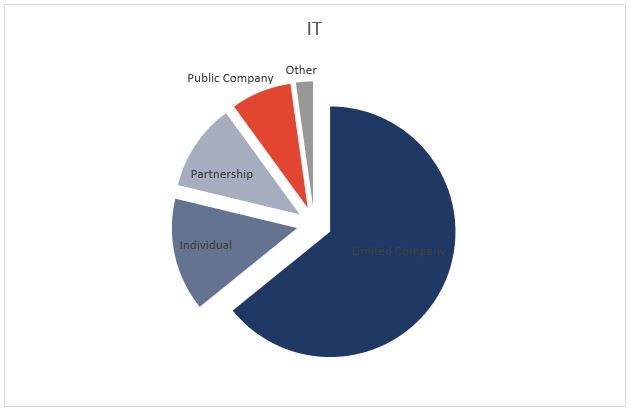

Similarly, the composition by the field Obligor Legal Form / Business Type shows most of the outstanding balance is exposed to Limited Companies in both countries while Individuals and Partnerships make much smaller share. It is important to observe the legal form for the purpose of this exercise as varying business sizes may determine the amount or structure of government economic support or assistance in the coming months.

DEAL LEVEL

Among the 21 SME transactions from Italy and 17 from Spain, individual deal composition can significantly vary. For instance, ED hosts 5 Spanish SME deals with 50% or more exposure to Individual while only 1 in Italy. Are individual businesses less exposed to the effects of COVID-19? Could individual business owners benefit from business grants and public assistance more than Limited Companies or Partnerships? Over time, our data will begin to answer some of these questions.

As a country that relies heavily on tourism, Italy is particularly exposed. Our platform has 4 Italian transactions with 20% or more exposure to both the Accommodation industry and Individuals compared to only 1 in Spain. It is important to note here that both Partnerships and Individual businesses are legally structured so that ultimately an individual could be personally financially liable for defaults.

At first glance, it appears more Spanish transactions are exposed to more Individual entities than Italy. However, when you dig deeper into the data, you can see that more Italian transactions are heavily exposed to individual businesses, specifically within the accommodation industry.

We’re focusing on individual businesses in this case, as they tend to have daily revenue, and daily cash flow can be more important for survival. Larger partnerships can often absorb significant financial losses and are backed by sophisticated financial structures and tools.

Loan-level data is powerful because data can be grouped according to industry, or other characteristics such as Obligor Legal Form OR, data can be analysed based on both criteria to determine exposure to both of these characteristics simultaneously.

ECONOMIC INSIGHT

Both Italy and Spain have introduced several emergency economic measures to support the economy, individual households, and SMEs. If effective, these measures could prevent or ease some of the most extreme effects we expect to see in the data. This includes support such as financial aid to families with children (Italy), the suspension of the eviction process for residential properties (Spain), suspension of mortgage payments (Italy and Spain), and cash support for qualifying individuals in both Italy and Spain.

Also notable are measures that impact both individuals and employers such as the suspension of permanent layoffs (Italy and Spain), and the suspension of contribution to pension plans and compulsory insurances (Italy).

For SMEs, most of the economic support comes in the form of easy access to loans guaranteed by the state. This is a notable departure from Germany, which has also offered cash grants to SMEs to support them during this time. Does this mean we will see less significant default rates for German SMEs compared to Spanish and Italian SMEs? Italy is allocating 200€ billion for firms operating in the export sector, which could alleviate some economic pressure on some (manufacturing) but not all (accommodation).

WHAT’S NEXT?

European DataWarehouse will continue to monitor the evolution and evidence of COVID-19 in our data set in the coming months and provide insight into economic indicators and trends across asset classes during the COVID-19 Pandemic. In our next blog, we’ll discuss the set of Consumer and Credit Card Loans in our data.