With EDW’s Extended Templates, reporting entities can quickly and easily meet both regulatory reporting requirements and rating agency data needs for the credit risk analysis of a transaction.

EDW EXTENDED (ESMA + RATING AGENCY) TEMPLATES

Satisfy ESMA and rating agency requirements needs with one template

EDW‘s Extended Templates enable reporting entities to seamlessly upload ESMA-compliant data to our Securitisation Repository platform whilst also providing rating agencies with the additional information required for their credit risk analysis of a transaction.

The uniquely designed templates eliminate the need for reporting entities to submit both a standard reporting template as well as a second loan tape for the rating agencies of their choice, therefore saving time and resources.

The EDW Extended Templates include all data fields that are required to meet the regulatory disclosure requirements under the Securitisation Regulation (EU) 2017/2402 while at the same time providing all the information required by rating agencies.

Key Features

- Includes all mandatory ESMA prescribed fields + relevant rating agency fields

- Submission via easy-to-use CSV format

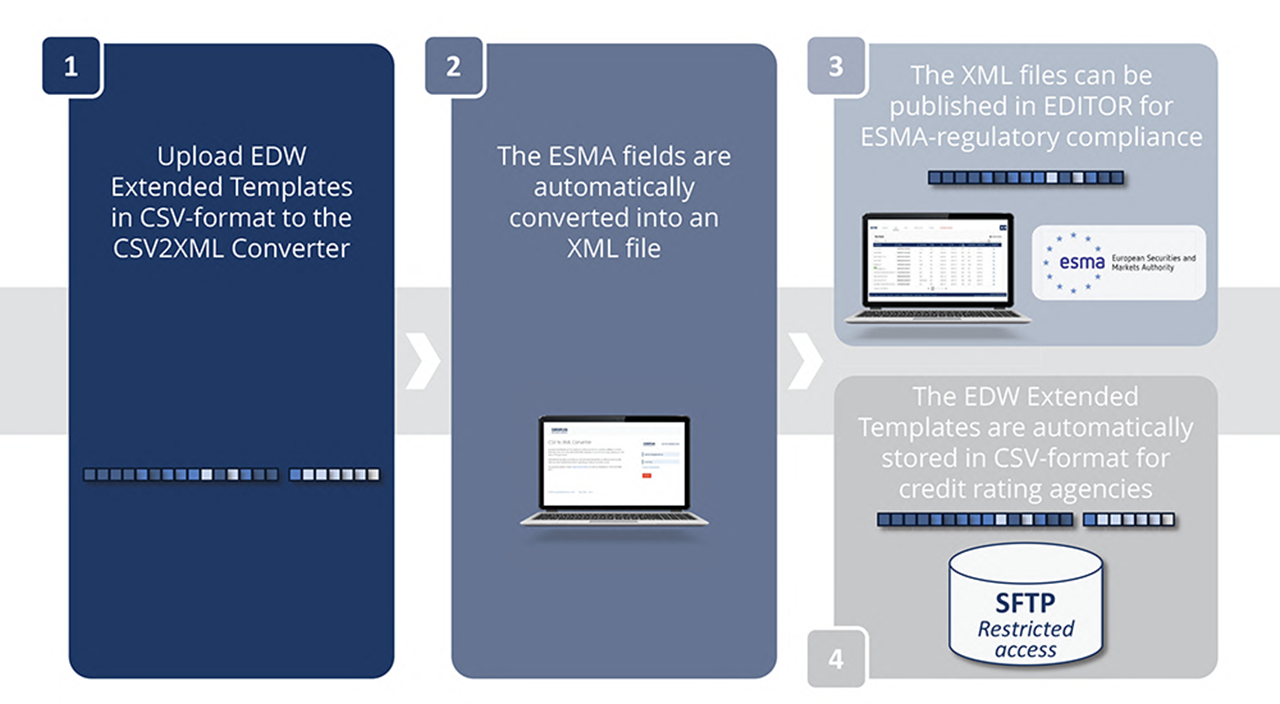

- Automatic generation of ESMA-compliant files in XML format using EDW’s CSV2XML Converter tool

- Restricted SFTP access for selected parties only

Streamline your regulatory and rating agency data submissions

Submitting data with EDW’s Extended Templates is quick, easy, and free to reporting entities using EDW’s premium Securitisation Repository solution, EDITOR.

After populating the templates in CSV format, the CSV file is uploaded to EDW’s CSV2XML Converter. The software then strips out the ESMA fields and converts them to an XML file, which is then published via EDITOR for regulatory compliance. The non-ESMA fields are stored in CSV format for rating agencies to access using a restricted SFTP server.

ESMA RULES WILL RAISE DATA QUALITY, BUT ADDITIONAL FIELDS WOULD AID CREDIT ANALYSIS

“On-going access to data beyond the disclosures introduced by new EU securitization regulation is required to support our credit analysis. The extended reporting templates proposed by EDW contain key information that will aid our assessment of credit risk, as detailed in our article.”

For free access to the article, click below and register to Moodys.com.

Collaborative data solution for the asset-backed securities market

EDW’s Extended Templates were born following the publication of ESMA’s underlying exposure templates.

The templates, however, no longer comprised valuable data fields required by rating agencies and market participants to update their credit and cash flow models.

EDW responded to this by launching a project with each of the four leading rating agencies, (DBRS Morningstar, Fitch Ratings, Moody’s Investors Service, and S&P Global Ratings) to introduce extended ESMA reporting templates for all asset classes and the investor reports.

The process took more than a year, whereby EDW approached each of the rating agencies separately to identify the fields previously included in the ECB templates which would still be needed to properly assess a transaction following the introduction of the ESMA templates.

In total, our teams identified and incorporated the following additional fields by asset class into the EDW Extended Templates:

Residential: 61

Auto: 11

Corporate: 22

Leasing: 12

Consumer: 15

Credit Cards: 5

CMBS: 9

Investor Reports: 97

NPL: 5

GETTING STARTED WITH EDW’S EXTENDED TEMPLATES

Users who are not subscribed to the EDITOR Premium platform, can benefit from the Extended Rating Agency Templates for a nominal fee in conjunction with the CSV2XML converter.

The templates can be accessed via https://csv2xml.eurodw.eu/ by logging in with your EDITOR credentials and downloading the “ESMA + Rating Agency CSV Template”. The download will begin as soon as you accept the License Agreement.

Once populated, users can convert the ESMA fields to XML and can choose to make the original CSV available to rating agencies after uploading the converted XML to EDITOR.