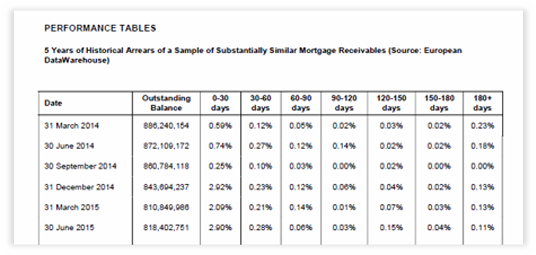

With over 1300 transactions in its database, EDW offers solutions for issuers, originators and SSPEs to comply with performance requirements relating to STS Transactions.

EDW can perform on-demand SQL queries to extract historical performance data from its database across asset classes for a period of at least five years. The performance data includes historical arrears and defaults for exposures similar to those being securitised.