Latest Update:

Report on the European Benchmarking Exercise for Private Securitisations

In 2021, European DataWarehouse (EDW) co-authored a report as part of the European Benchmarking Exercise (EBE), a market-led initiative organised by Association for Financial Markets in Europe (AFME), EDW and True Sale International GmbH (TSI). EDW updated the report in July 2022 with the latest figures up to the end of 2021.

The purpose of the EBE is further to enhance the quality and usefulness of disclosure in the EU and UK private cash securitisation markets, both ABCP and balance sheet financed, to assist market participants and reassure supervisors. Synthetic securitisations and public ABS bonds are not in scope of this report.

The report provides aggregated transaction-level data on a voluntary basis gathered from 12 banks (BayernLB, BNP Paribas, Commerzbank, Credit Agricole, DZ Bank, Helaba, HSBC, ING, LBBW, Natixis, RBI and UniCredit) across 6 countries (Austria, France, Germany, Italy, Netherlands, and the UK).

EDW contributed to the writing of the report by centralising and processing the aggregated data on private securitisations received from the 12 participating banks. Loan-level data from EDW’s securitisation repository platform was not used for this exercise and all analysis, aggregation, and publication has been made on the basis that specific data cannot be identified to the contributing bank or to the underlying transaction.

In particular, the report highlights:

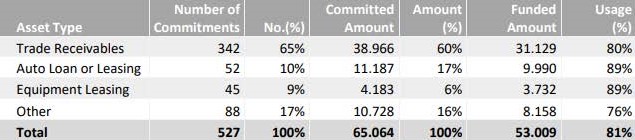

- the overall private securitisation market is estimated at least €184bn of total commitments, with the exercise-related dataset covering €65bn of those commitments.

- private securitisations backed by trade receivables and auto loans or leasing contribute to around 78% of the market, of which 34% and 89% respectively are funded through syndicated transactions.

Committed and Funded Amount for main Asset Types

This is the second in a series of such reports, to be published regularly over time, providing a useful overview of the private cash securitisation market and its importance in funding the “real economy.”

|

Download REPORT

Click below to download a copy of the latest European Benchmarking Exercise report.