How to Use Underlying Exposure Data to Support the Calculation of Capital Requirements for Securitisations

Article 7 of the Securitisation Regulation (EU) 2017/2402 requires the disclosure of detailed, loan-by-loan information for all securitised assets. This level of transparency is highly valuable—not only does it allow investors and market participants to monitor portfolio performance and better understand the risk characteristics of the underlying loans, but it also plays a critical role in regulatory compliance.

In particular, the granular data is essential for the calculation of risk-weighted assets (RWA) under the Capital Requirements Regulation (CRR), as amended by Regulation (EU) 2017/2401.

Hierarchy of Methods as per Article 254

Article 254 of the Capital Requirements Regulation (CRR) establishes a clear “Hierarchy of Methods“ that institutions must follow when calculating risk-weighted exposure amounts for securitisation positions. The hierarchy is as follows:

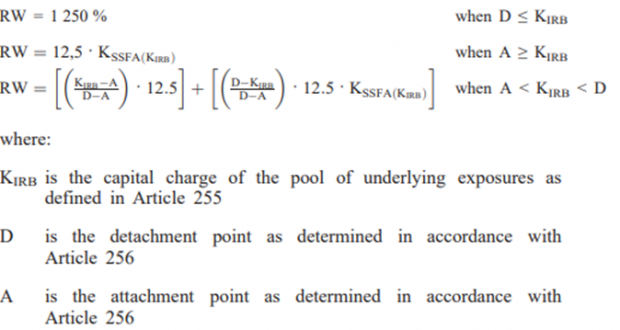

- Where the conditions set out in Article 258 are met, institutions must use the Securitisation Internal Ratings-Based Approach (SEC-IRBA), as detailed in Articles 259 and 260. This approach relies on the institution’s internal models for credit risk, subject to supervisory approval and sufficient information on the underlying exposures.

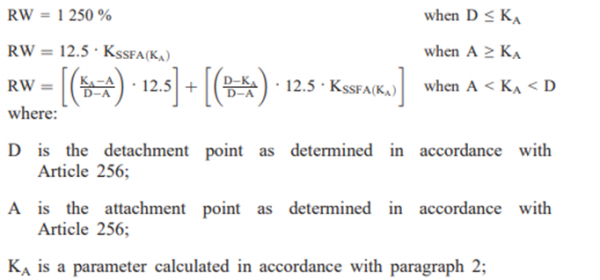

- If the SEC-IRBA cannot be used, the Securitisation Standardised Approach (SEC-SA) must be applied in accordance with Articles 261 and 262. The SEC-SA uses prescribed supervisory formulas and standardised risk weights for the underlying exposures.

- Where neither the SEC-IRBA nor the SEC-SA can be used, the Securitisation External Ratings-Based Approach (SEC-ERBA) is to be used, as set out in Articles 263 and 264, provided the position is rated or an inferred rating can be used.

This hierarchy aims to promote consistency and prudence in the calculation of capital requirements for securitisation exposures.

Source: CRR Regulation

Source: CRR Regulation

External Ratings Based Approach (SEC-ERBA)

Under the SEC-ERBA, the risk-weighted exposure amount is calculated by multiplying the exposure value of the securitisation position as outlined in Article 248 with the risk weight that applies to the position, as specified in Article 263 / 264.

Using ESMA Loan-by-Loan Data for Risk Assessment and Regulatory Compliance

By using the comprehensive and standardised data provided by the ESMA templates at the loan level, market participants can effectively calculate the key risk parameters on which the risk calculation methodologies described above are based.

Example I: Calculating Attachment Point

A clear example is the calculation of the Attachment and Detachment Points. These parameters define the thresholds at which losses from the underlying asset pool begin to affect a particular securitisation tranche (attachment point), and the point at which that tranche has absorbed all potential losses (detachment point).

For instance, when calculating the Attachment Point, the first step is to extract the total outstanding balance of the pool and the amounts for each tranche. This information is available in the ESMA templates for underlying exposures (such as Annex 2 for RMBS, Annex 5 for Auto ABS, and Annex 6 for CMR), as well as the Annexes Inside Information and Significant Event.

The next step is to check whether there is overcollateralisation in the transaction; the ESMA templates provide a dedicated field for ‘Current Overcollateralisation’ to facilitate this check.

Finally, the reserve fund amount can be identified by reviewing the cash-flow information section within the Investor Report template.

Example II – Calculating the parameters “W” and “KSA” under the Standardised Approach (SEC-SA)

Another practical example is the calculation of the W parameter under the Standardised Approach (SEC-SA). The W parameter is determined by dividing the total amount of underlying exposures in default by the total amount of all underlying exposures in the securitisation pool.

Identifying exposures in default requires applying the criteria set out in the Standardised Approach, such as loans that are 90 days or more past due. The detailed, loan-level granularity provided by ESMA’s reporting templates makes it possible to accurately identify and quantify these exposures.

Looking further into the SEC-SA, the calculation of the KSA parameter also relies on loan-by-loan data. KSA represents the weighted-average capital charge of the entire pool of underlying exposures, calculated using the specific risk weights assigned to each loan as defined in Chapter 2 of the CRR.

For instance, under the Standardised Approach in the CRR, consumer loans that qualify as retail exposures generally carry a risk weight of 75%. In contrast, exposures secured by residential real estate—provided they meet specific regulatory criteria—may benefit from a lower risk weight of 35%.

Access to granular loan-level data, such as that provided by ESMA templates, ensures that these risk weights are applied accurately to each underlying exposure, supporting robust and transparent risk assessment for securitisation positions.

To learn how ESMA loan-by-loan data can improve your risk assessment and regulatory compliance, contact us. Our experts are ready to help you make the most of this valuable data for your risk management and reporting requirements.