ABS Structuring: How EDW Can Provide Support Throughout the Life of a Transaction

The Asset-Backed Securities structuring process is a multifaceted and complex procedure with various activities, often occurring in parallel. Many different counterparties are engaged, and much information and data must be exchanged among the involved parties.

EDW offers various services and activities that facilitate efficient handling of the ABS securitisation structuring process.

EDW’s involvement in securitisation encompasses structuring and ongoing administrative processes throughout the transaction’s life.

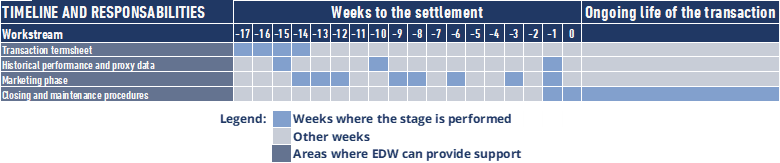

Below is a generic segment within the broader workstream timeline:

EDW through the life of the transaction

EDW converts your raw data into a reader-friendly format that supports an efficient portfolio selection process and helps to prepare data for all related transactions and relevant counterparties.

EDW’s bespoke converter saves time; data is standardised and can be visualised and easily analysed from the beginning.

With this converter, EDW can help the issuer in several stages of the structuring process.

1. Tranaction term sheet :

Spanning the European market, EDW’s extensive securitisation data repository serves as a pivotal resource for issuers navigating the intricacies of crafting a term sheet.

EDW facilitates insightful market comparisons and sheds light on intricate counterparty relationships. Through EDW’s platform, issuers gain a nuanced understanding of prevailing market conditions, enabling them to optimise their term sheets with precision.

EDW empowers issuers by translating complex data into strategic decisions, ensuring clarity, efficiency, and well-informed choices throughout the entire term sheet creation process.

2. Historical performance and proxy data:

EDW can provide a complete analysis to the issuer regarding the historical performance of similar deals.

Below is a description of how the proxy data is designed:

Over the past 10+ years, EDW has collected loan-level data for more 1700 transactions from 15 jurisdictions across seven asset classes. This enables us to offer solutions for issuers, originators, and SSPEs to comply with performance data requirements to achieve the STS Label for their new transactions.

The performance data includes static Default/Loss and Dynamic Arrears information for at least five years, a pre-requisite according to the Securitisation Regulation 2017/2402 (EU).

3. Marketing phase

During the marketing phase, EDW’s platform serves as a valuable deal data room, providing investors with access to all relevant information. Additionally, EDW’s active connections with transaction-relevant partners globally enhance deal visibility and conditions.

4. Closing and Maintenance procedures

In the closing and ongoing procedures, EDW plays a crucial role, offering support through:

- Alert system for issuers: Reminding issuers to report in compliance with regulatory requirements, ensuring market integrity.

- Efficient stakeholder notification: Promptly informing relevant parties about newly submitted information, facilitating well-informed decision-making and effective oversight.

- Periodic Deal Reports: Presenting bespoke charts, tables, averages, min–max overviews after each data submission. Users can access relevant periodic data from deals and compare them with benchmarks.

In summary, EDW streamlines information flow in the financial market, ensures regulatory compliance, and enhances transparency, benefiting issuers, investors, and regulatory authorities alike.