Are Variable Interest Rates Driving Up Mortgage Delinquencies?

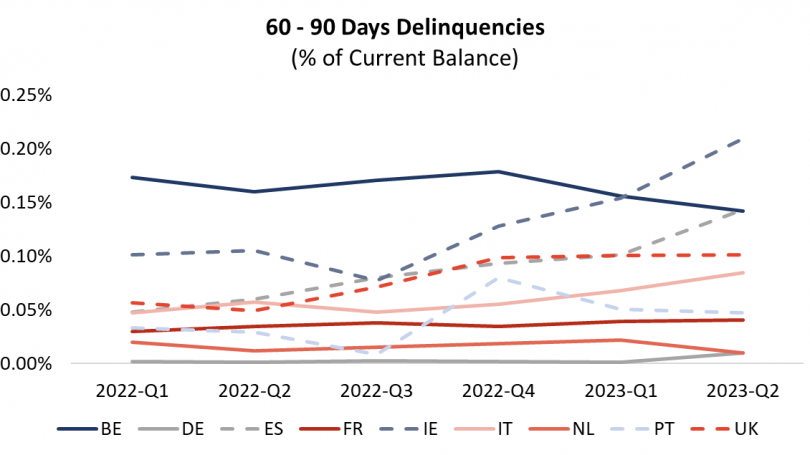

Since Q1 2022, 60-90 days mortgage delinquency rates have been stable in some countries and increasing in others (Exhibit 1).

This early delinquency trend indicator increased the most in countries where variable-rate mortgages are commonly used, suggesting that interest rate type has become a key determinant of loan performance in the context of increasing interest rates.

Exhibit 1: Delinquency Rates Are Stable in Countries Where Interest Rates Are Mostly Fixed

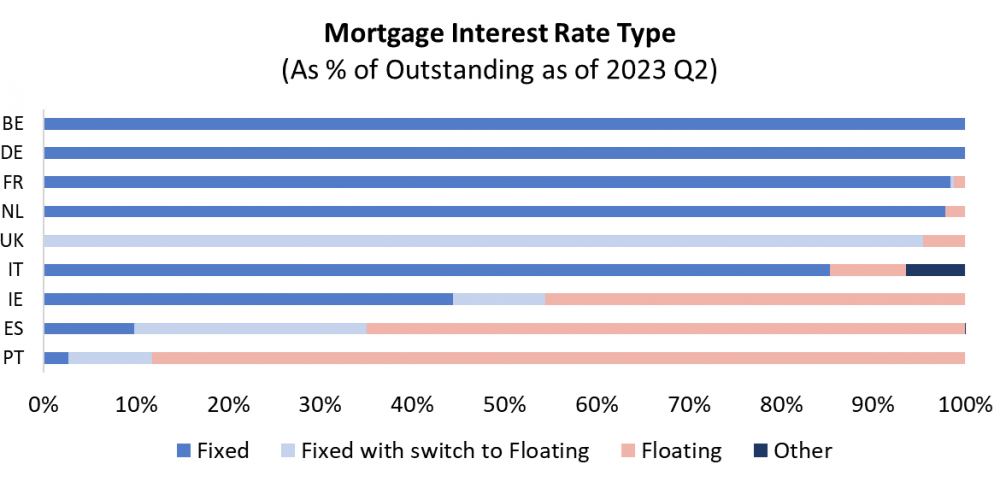

In the Netherlands, France, Germany and Belgium, where the delinquency rates barely increased, mortgages are almost exclusively fixed-rate. Variable-rate loans are more common or even prevalent in Portugal, Spain and Ireland, where an increasing delinquency trend is visible (Exhibit 2).

In the United Kingdom, loans almost always have a short fixed-rate period with a switch to floating rates afterwards.

Exhibit 2: Not All Mortgages Have Variable Interest Rates

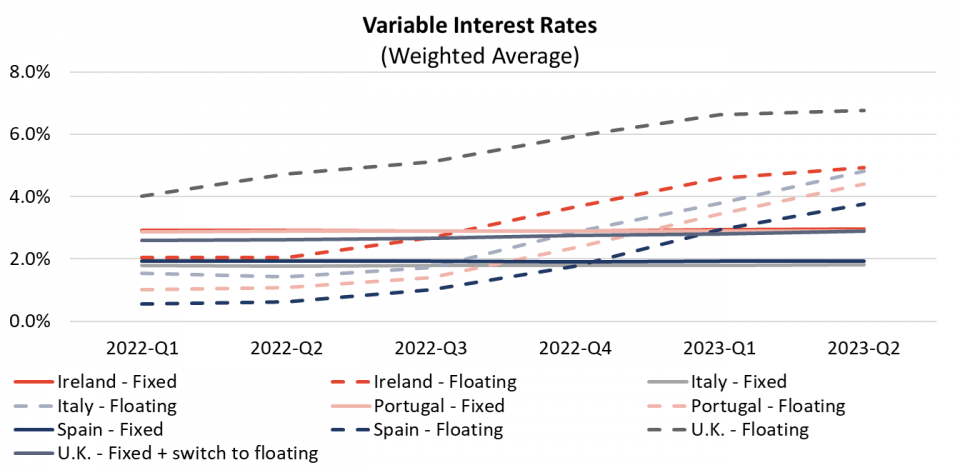

Variable interest rates of the mortgages reported to our database have increased substantially recently, reflecting the general trend (Exhibit 3).

When the interest rate on a 20-year EUR 100,000 loan increases from 1% to 4%, the monthly instalment changes from EUR 460 to EUR 605, a 30% increase.

The impact is more severe for longer-term loans. This, combined with the general context of inflation, can make borrowers more likely to default on their loans.

Exhibit 3: Variable Interest Rates Have Increased Recently

We note that in most cases, in 2022-Q1, fixed interest rates were higher than variable rates. Currently, the rates paid on variable-rate loans are higher than for fixed-interest rate loans.

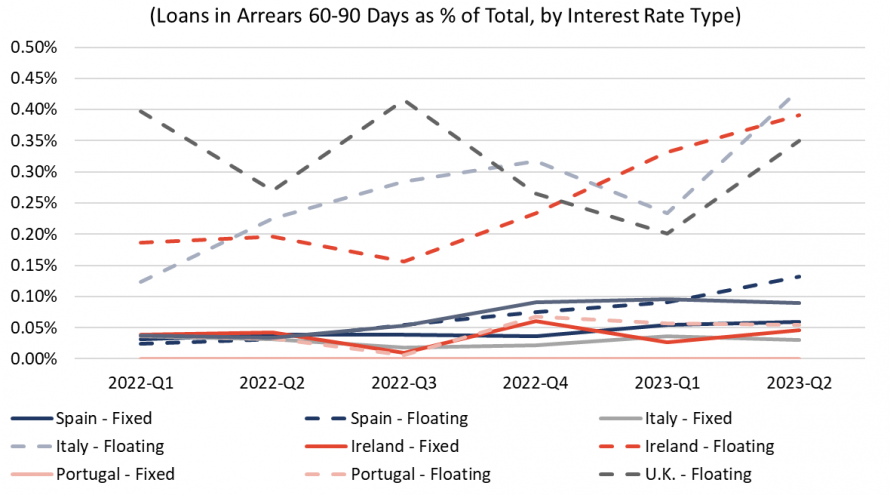

In countries where both variable- and fixed-interest loans are available, loans with variable interest rates almost always have higher delinquency rates than loans with fixed interest rates (Exhibit 4).

We note also that variable interest rate loans already had higher arrears in Ireland and Italy even before interest rates started to increase.

Exhibit 4: Variable-Rate Loans Have Higher Delinquencies

To make these charts, we selected deals for which ESMA data has been reported consistently over the period to avoid changes in arrears patterns due to the sudden inclusion of a new portfolio from which loans in arrears are originally excluded. We excluded deals that report no delinquencies (which could imply that delinquencies are systematically repurchased), or where delinquency patterns imply data reporting peculiarities.