Attachment Points in Focus: Insights from EDW Data

The recent proposal by the EU Commission to reform the EU securitisation framework introduced the concept of ‘resilient’ securitisation positions. Resilient securitisation positions are senior positions with a robust loss absorbing capacity for the senior positions.

The proposal mentions attachment points as a possible eligibility criterion to define resilient securitisations. The aim of the European Commission is to introduce more risk sensitivity in the prudential framework. This means that the capital requirements are being improved to better reflect the actual risk of the different underlying securitisation portfolios. In turn, this will allow banks to be more flexible with their capital allocation. Requirements will be lower only for the senior tranches in “resilient securitisations” where specific risks have been largely mitigated, and which comply with a set of safeguards. It is therefore important to investigate where the current average attachment points of existing term securitisations stand.

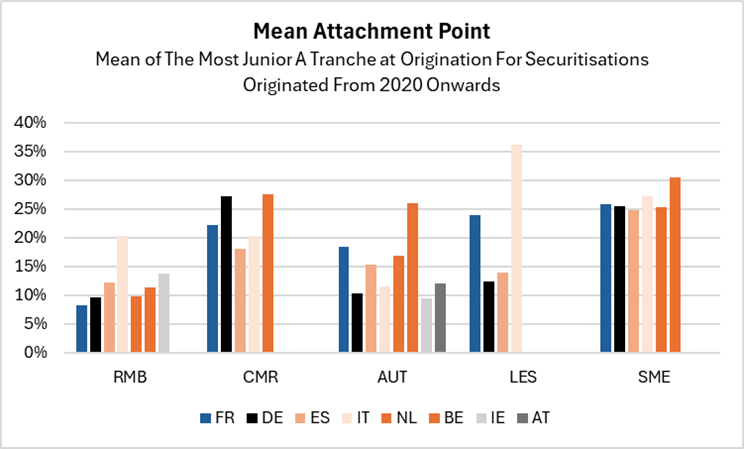

As part of the disclosure obligations under the EU Securitisation Regulation, the Original Attachment Point is to be provided to European DataWarehouse (EDW) as part of Annex 14 as field SEST32, along with the Current Attachment Point (SEST31), the Current Credit Enhancement (SEST33) and the Original Credit Enhancement (SEST34). Exhibit 1 displays the mean reported Attachment Point per country and asset class for the most junior Class A type tranche at origination for the securitisations issued from 2020 onwards.

Exhibit 1: Mean “Class A” Attachment Points

Source: European DataWarehouse

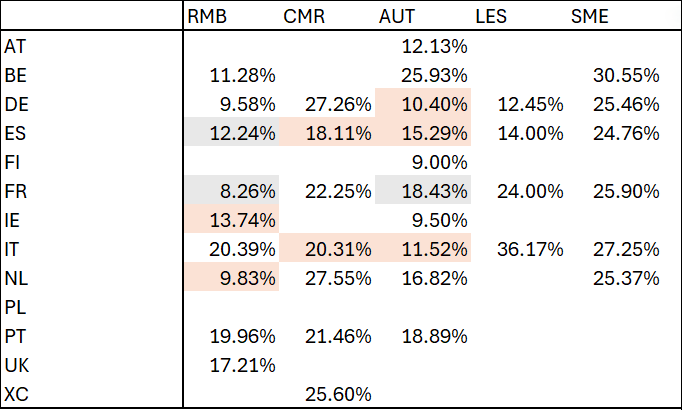

Exhibit 1 shows that for RMBS, Class A mean attachment point is in the 10% to 12% range, vs more than 25% for SMEs. There can be substantial differences across countries, depending on the specificities of the securitisation markets due to different legal frameworks, loan granting practices and fiscal incentives. Exhibit 2 provides a more complete picture than Exhibit 1, in which we included only the countries with the most deals or represented in the most asset classes to improve readability.

Exhibit 2: Mean Class A Attachment Points

Source: European DataWarehouse

The values we used in Exhibit 1 and 2 are those we found to be accurate. We selected for each securitisation the Annex 14 data as provided in the last available data upload. We considered only the attachment points of the A tranches or equivalent; when a deal has several Class A tranches, we considered the attachment point of the most junior Class A for that deal.

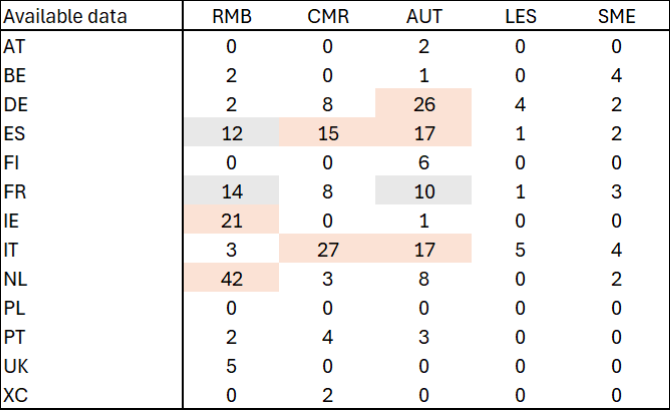

Exhibit 3: Number of Available Observations

Source: European DataWarehouse

Not all the data available in the fields SEST31, SEST32, SEST33 and SEST34 was usable. In various cases, these fields contained decimal point errors (a 12% attachment point or credit enhancement should be reported as 12 not 0.12). We also found ND values or values which we could not recalculate. EDW is currently in the process of liaising with clients to continue improving data quality.

For more information on the EDW queries and data analysis, please contact us at enquiries@eurodw.eu. A full presentation was made during EDW’s Q4 Research Update Webinar on 16 December 2025. The webinar slides and recording are available for download here.

1 On attachment point calculations, see, for instance, CRE44 – Securitisation: Internal-ratings-based approach.

2More information is available on the European Commission website.