EDW CONDUCTS GAP ANALYSIS ON THE PROPOSED EBA NPL DATA TEMPLATES

Information asymmetries and lack of information provided in a standardised and common format are the key challenges highlighted by the European Banking Authority (EBA) for the development of an efficient secondary market for non-performing loans (NPLs) sale.

After the development of the NPL templates in 2017-2018, and the subsequent market-based consultation in the summer of 2021, EBA launched a public consultation in May 2022 on the draft Implementing Technical Standards (ITS) specifying the requirements for the information that sellers of NPLs shall provide to prospective buyers.

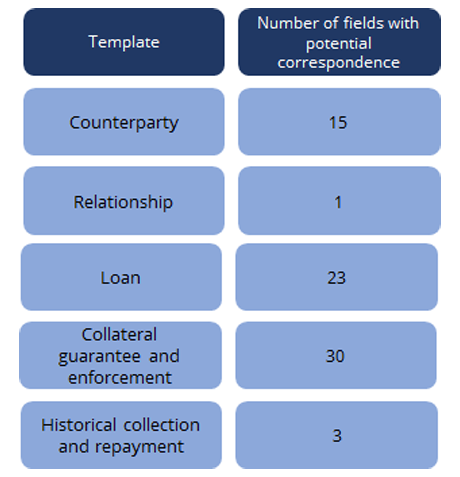

In this context EBA proposes a set of five templates:

- Counterparty (Template 1)

- Relationship (Template 2)

- Loan (Template 3)

- Collateral, guarantee and enforcement (Template 4)

- Historical collection and repayment (Template 5)

The EBA templates should be used by credit institutions for new NPL sales for loans originated on or after 1 July 2018, that became non-performing after 28 December 2021, and are not included in securitised portfolios, setting the basis for a standardised data reporting for the sale of these type of assets.

In light of this, European DataWarehouse (EDW) is conducting a Gap Analysis on the main differences between reporting requirements under the European Securities and Markets Authority (ESMA) as part of the Securitisation Regulation for NPL securitisations and the new proposed EBA NPL data templates to be filled in by a credit institution when selling non-performing loans.

This article sets to explain the methodology behind EDW’s analysis of the data fields proposed by EBA and highlights some of the preliminary results from its 2022 EBA NPL Template GAP Analysis (Version 1.0).

Purpose of new implementation and changes from previous EBA NPL Data templates

Based on the experience gained from its 2021 consultation, EBA’s proposed NPL data templates are being further refined to facilitate the more efficient sale of NPLs by banks as part of their management strategies in the context of the COVID-19 pandemic. At the same time, they are also aimed at addressing asymmetric information to promote price discovery between buyers and sellers.

The EBA revised NPL data templates reflect the experience of market participants on both the buy-side and sell-side, and the current consultation is a key opportunity to gather feedback from all stakeholders to facilitate the widespread use of EBA templates across the single market.

They also aim to enhance granularity via the provision of loan-by-loan reporting, quality, and comparability of NPL data as well as at increasing transparency and market certainty.

Compared to the first versions release, the number of data fields in the newly proposed EBA NPL data templates have been reduced from 453 to157, out of which 91 are mandatory for loans carrying a nominal amount below 25 000 euros, and 133 mandatory fields for loans exceeding this threshold.

EDW GAP analysis methodology and results

We focus our analysis on the main differences in the reporting requirements under ESMA as part of the Securitisation Regulation for NPL securitisations and the new proposed EBA data templates for NPL sales.

Under the ESMA regime issuers of NPL securitisations are required to use a dedicated add-on for NPL transactions, i.e., Annex X of the disclosure ITS .

Our assessment considers therefore the proposed EBA NPL data templates and compares them with this Annex X. The goal is to facilitate market participants, active in both the sale of whole loans portfolios and securitised portfolios, in finding the common points between the two reporting regimes.

We found potential correspondence in the two templates for multiple fields, as shown below.

Table 1: Fields with potential correspondence between the proposed EBA NPL data templates and the ESMA

templates. Sources: proposed EBA NPL data templates, ESMA templates, and EDW assessment

This correspondence is based on a perfect match, as highlighted also in the templates made available by EBA and on a field-by-field approximation following analysis of the ESMA annexes.

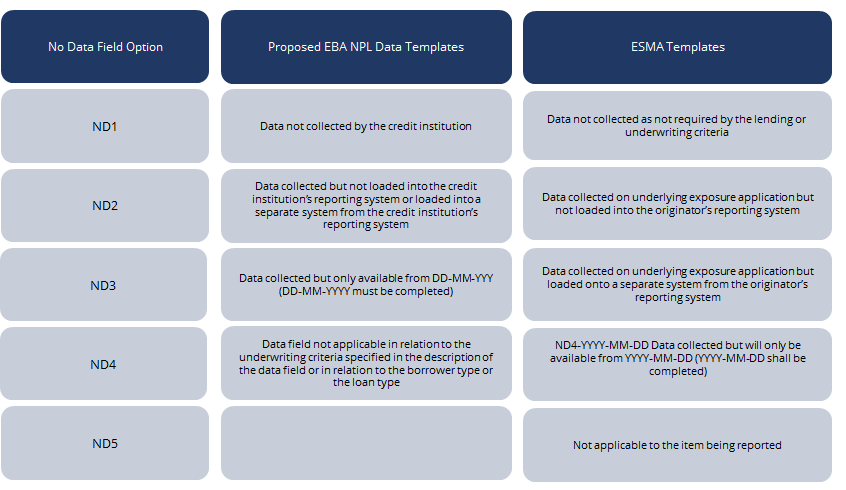

In consideration of the potential lack of data availability, EBA includes four different types of No Data options for non-mandatory fields.

In the case of mandatory fields, only the use of one type of No Data option is permitted (ND4: data field not applicable). We compared the No Data options of EBA NPL data templates with the ones included in the ESMA reporting, highlighted in the table below.

Table 2: Options to report No Data in the proposed EBA NPL data templates and the ESMA templates.

Sources: EBA Templates, ESMA Templates, and EDW assessment

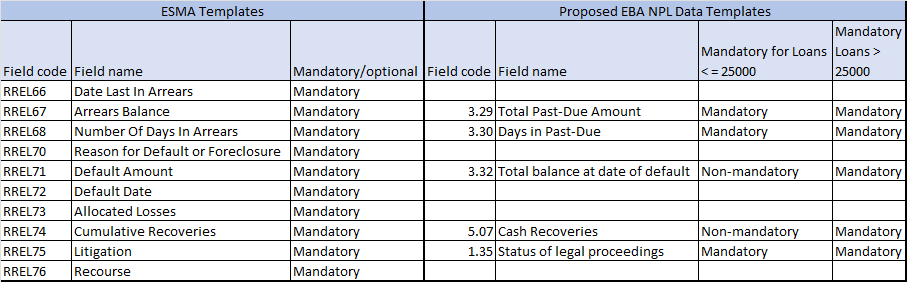

Particularly relevant for the assessment of non-performing loans are also the fields related to delinquencies, defaults, and recoveries. For illustrative purposes, we display below the key fields under the ESMA templates and the proposed EBA NPL data templates.

Table 3: Fields for Delinquencies, Defaults, and Recoveries included in the ESMA templates and in the proposed EBA NPL data templates.

Sources: ESMA templates, proposed EBA NPL data templates and EDW assessment

The EBA consultation ends on 31 August 2022, with the EBA NPL data templates and taxonomies expected to be finalised by the end of 2022.

You can find more information about the consultation by referring to the presentation slides featured in EDW’s recent webinar ‘Shaping the Future of NPL Reporting.’ The webinar featured a keynote from EBA’s Oleg Shmeljov & Lidja Schiavo discussing the Consultation Paper on ITS for NPL Transaction Data Templates.