What European DataWarehouse RMBS Indices Tell Us About European Mortgages in Q4 2025

According to European DataWarehouse’s (EDW) updated Q4 2025 RMBS Index, RMBS delinquency levels across most European countries currently sit close to 10-year lows, with the main exception being the UK. The index also shows that short-term delinquencies reacted sharply to past crises, while longer-term arrears proved more resilient, particularly during the COVID-19 pandemic.

Thanks to EDW’s All-in-One Database (AIO), performance indices such as this one are now much easier to build and analyse. The AIO brings historical loan-level data from ECB, ESMA, and FCA template submissions into a single database and adds calculated fields designed for time-series analysis, as described in our All in One Database Methodology.

European RMBS Delinquency Trends based on a Decade of Data

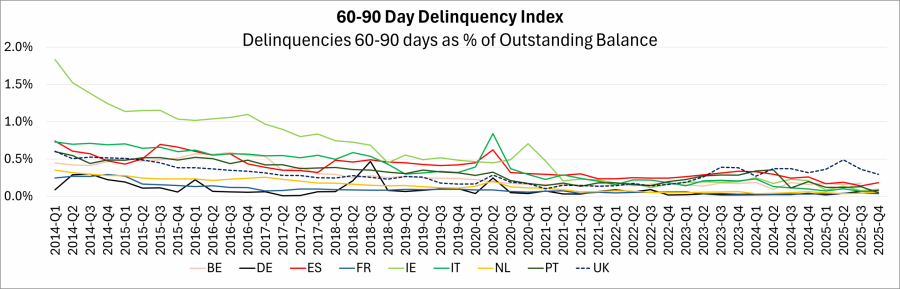

Using the AIO, EDW extracted data to build a 60–90-day delinquency index (Exhibit 1), a short-term indicator that responds quickly to changes in the macroeconomic environment. The index demonstrates that delinquencies peaked in Q1 2014, following the Global Financial Crisis (GFC), and then declined steadily. Several countries show clear spikes in Q2 2020 during the COVID crisis, but these increases faded quickly thereafter.

Exhibit 1: 60–90 Day Delinquency Index

Source: European DataWarehouse (All-in-One Database)

The data also shows Ireland previously recording the highest mortgage arrears until the COVID crisis, alongside Spain, Italy, and Portugal, which were also severely hit during the GFC. After the crisis, delinquency levels in these countries improved markedly. Their trends broadly track national economic cycles, with visible but controlled fluctuations.

France, Germany, and the Netherlands stand out for their stability, with delinquency rates for these countries remaining consistently and significantly lower than elsewhere. Conservative mortgage lending criteria, strong regulation, and stable housing markets support this performance.

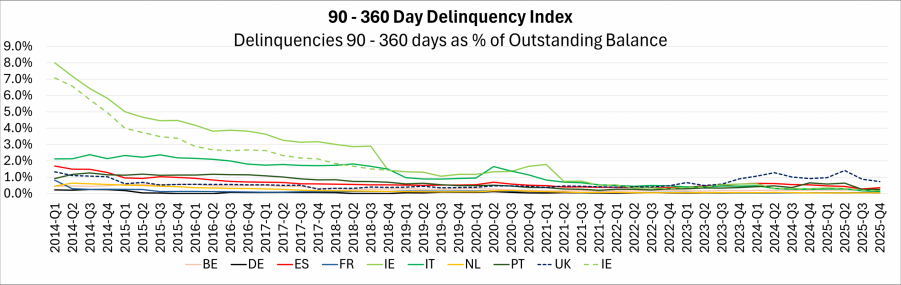

As shown in Exhibit 2, 90–360-day delinquencies barely reacted to COVID. Many COVID-related arrears entered moratoria rather than default. As a result, longer-term delinquency levels continued to fall and now stand near decade lows in most markets. This longer-term index demonstrates more inertia than the 60-90 day short-term index. The particularly strong results in Exhibit 2 also reflect loan management practices, such as earlier repurchases or restructurings once loans fall into arrears.

Exhibit 2: 90–360 Day Delinquency Index

Source: European DataWarehouse (All-in-One Database); dashed line for Ireland excludes the worst performing “Celtic” series.

Please note that Ireland is represented by two index lines in Exhibit 2. The dashed line excludes the “Celtic” deal series, and following their termination in 2018-Q4, the index drops sharply. Despite this, delinquency levels across most Irish deals have remained high since 2014.

A crucial chapter in this decade-long story is the year 2020. The chart shows a modest but visible increase in delinquencies across several countries, notably Italy and Ireland. This was the direct, temporary impact of the COVID-19 pandemic and associated economic lockdowns.

It is critical to emphasise that this trend was consistent across the sector and not isolated to specific deals. The increase was a systemic reaction to an unprecedented external shock. As government support measures took effect and economies reopened, the data clearly show that delinquency rates stabilised and receded soon after, underscoring the underlying resilience of the securitised portfolios.

How EDW Calculates RMBS Indices

The 60–90-day delinquency index, Exhibit 1 shown above, measures the share of European mortgages securitised from 2014-2024 in arrears for 60–90 days (ESMA reporting) or two months (ECB reporting) relative to the total balance of active mortgages.

The 90–360-day delinquency index measures the same share of mortgages in arrears for 90–360 days (ESMA reporting) or three to twelve months (ECB reporting), again relative to the total balance of active mortgages present in European RMBS transactions submitted to EDW’s platform.

Deals are included in this index only once they reach one year of age. Including newer deals would distort the results, as newly closed transactions typically have no arrears, inflating the denominator while leaving the numerator empty.

A small number of deals that did not report any delinquency data were excluded. These exclusions reflect differences in portfolio management or reporting practices, such as systematic repurchases of delinquent loans or non-standard arrears reporting. Removing them ensures the index reflects consistent and comparable portfolios. A full list of excluded deals is maintained in a separate log.

Please note that not all deals hold the same weight in the index, adding or removing a deal (as was the case with the Celtic series for Ireland) can result in a visible change of pattern in the index.

Leveraging the AIO Database to Simplify Index Construction and Data Quality

In addition to consolidating historical and current regulatory loan-level data reported under the ECB, ESMA, and FCA frameworks, EDW’s AIO also simplifies index construction and improves data quality by:

- Correcting errors in ECB data that would otherwise distort results.

- Simplifying the merge of ECB and ESMA data by using the select_unique field to prevent double-counting and data_origin to track data sources.

- Standardising reporting frequency to account for the fact that some deals report monthly, others quarterly. As such, the QTR field ensures each deal enters the index only once per quarter, avoiding triple-counting of monthly reporters.

Please request a copy of EDW’s AIO Database Methodology Report to learn more about how this consolidated dataset can be used to create indices across six main asset classes. The methodology is a free resource. If you would like to purchase access to the complete All-in-One Database itself, please email enquiries@eurodw.eu.