Estimating CO2 Emissions in European Securitisations

As project partner of the Green Auto Securitisation (GAS) initiative, European DataWarehouse (EDW) provides the Leibniz Institute for Financial Research SAFE in Frankfurt with enhanced loan-level data to enable research on ESG considerations affecting auto and leasing securitisations, with the aim of facilitating the financing of low-emission vehicles.

Since the project started in October 2022, EDW has improved data standardisation and comparability of its existing auto loans and leases, enhancing it with additional ESG information to create a dedicated GAS database.

Reporting of Energy Performance Data on the Rise

Under current European Securities and Markets Authority (ESMA) regulation reporting standards, issuers of Auto ABS transactions are required to report information on the Energy Performance Certificate (EPC) of the securitisation’s underlying assets, if available.

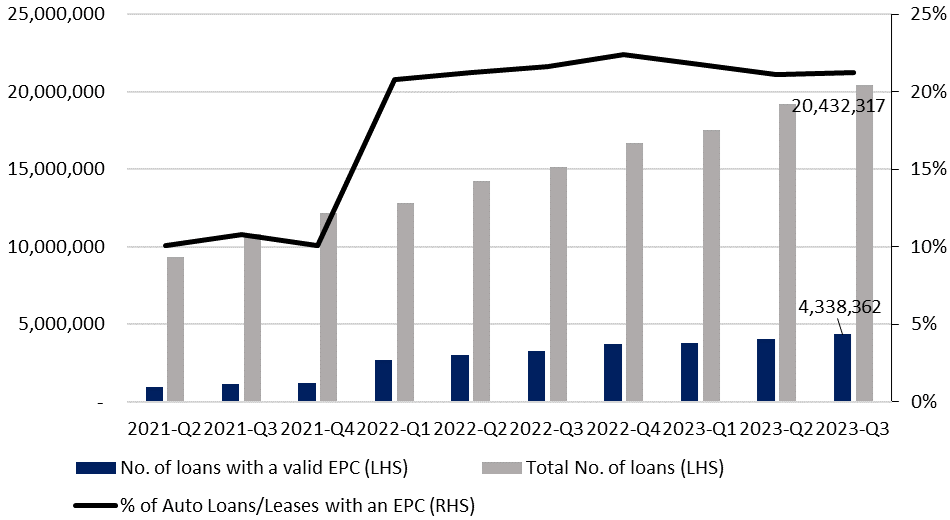

As shown in Figure 1, the number of EPCs available on EDW’s securitisation repository platform is steadily increasing, exceeding 4 million observations as of Q2 2023.

Figure 1: Auto Loans – Number of Loans Reporting a Valid EPC in ESMA

Source: European DataWarehouse dataset and calculations. Data as of Q2 2023

This extensive data set is a clear signal of the growing importance given by the market to disclosing energy-related information. It also holds true on the investor side, with asset managers required to disclose their due diligence policies under Article 4 of the SFDR concerning the sustainability of their investments.

As already indicated in previous EDW research webinars, these labels have some limitations due to the differing calculation methods across countries.

The French EPC corresponds simply to an emissions range, whereas the German EPC is also scaled for the weight of the car. The same car could therefore have very different EPCs in France and in Germany.

Enriching Standardised Data to Derive Average CO2 Emissions

Existing energy-related information can also be enriched with data from the European Environmental Agency (EEA) database, whose dataset contains detailed information on the CO2 emissions of all passenger cars.

As EDW loan-level information for manufacturer, model, and registration year is standardized and fuel type can be derived from these variables, the data can be linked to the EEA dataset.

Using EDW data we implied the fuel type wherever possible by taking fuel-related information from the model name (eg VW GOLF TDI implies diesel, TFSI indicates petrol, and E-Golf signals electric). If no match for a fuel type is made, it is assumed that the car is not electric or hybrid, and the average CO2 emissions for the specific model, year, and country for petrol and diesel cars is derived from the EEA database.

This solution allows for the estimation of average CO2 emissions for each year/model/country. Additionally, this model is tested by considering both an unweighted average and a weighted approach by the loans’ outstanding balance.

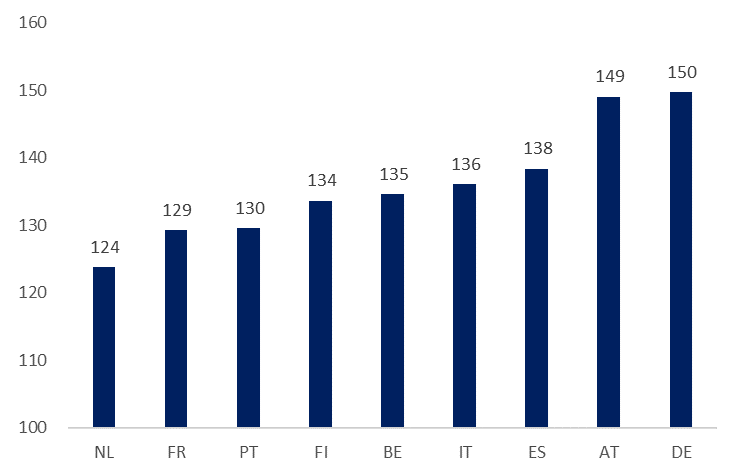

Figure 2 shows the aggregate results by country of the underlying assets. The results highlight the heterogeneity of cars’ CO2 emissions in Europe, with Netherlands showing the lowest emissions, at an average of 124 g/km, and Germany and Austria with the highest.

Figure 2: Average CO2 Emissions (g/km) per Country (WLTP Standard weighted by Balance of loans)

Source: European DataWarehouse dataset and calculations. Data as of Q2 2023

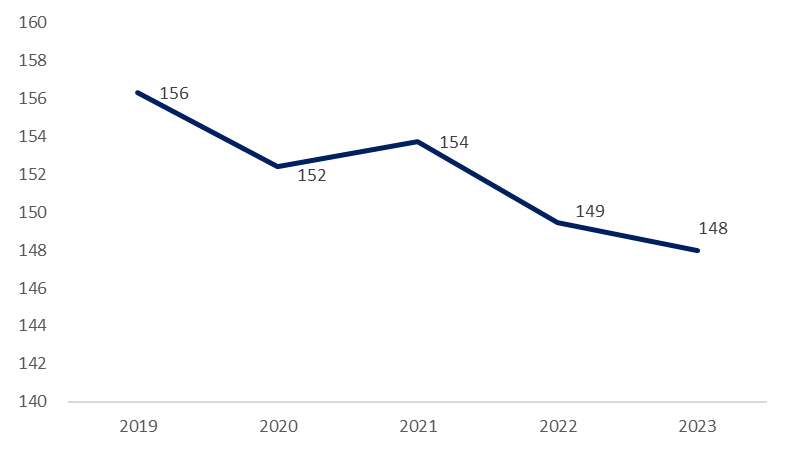

While Germany has the highest level of emissions throughout all ESMA transactions, which may be driven by the fact that German car manufacturers produce on average bigger and therefore heavier cars, Figure 3 shows a decreasing trend in average CO2 emissions for new ABS deals from Germany.

Please note that Auto ABS deals often contain a significant portion of used cars which can lead to higher average CO2 emissions than would be expected if the transaction contained only new cars sold in the year of issuance.

Figure 3: Average CO2 Emissions (WLTP standard, g/km) for German ABS Transactions by Year of Issuance

Source: European DataWarehouse dataset and calculations. Data as of Q2 2023

In addition to sharing further findings on the EDW Insights webpage and in future research webinars, EDW and Leibniz Institute for Financial Research SAFE will host a dedicated GAS workshop on 8 November at the Goethe University in Frankfurt.

The agenda will touch upon the incentives for ESG disclosure and the possible introduction of a blueprint for sustainable auto and leasing securitisations. Speakers include Dianora Aria De Marco (ISSB), Liliana Bara de La Fuente (ECB), Loriana Pelizzon (SAFE), Jacob Binnema (MUFG), Paolo Conti (DBRS), Jan Peter Hülbert (TSI), and Steven Ongena (University of Zurich).

The registration page and additional information is available by clicking below.