European Benchmarking Exercise for Private

Securitisations Now Covers One Complete Year

European DataWarehouse (EDW), in partnership with TSI and AFME, has co-authored a report as part of the European Benchmark Exercise on private securitisations.

In particular, EDW has collected and aggregated confidential data on private securitisations provided for this specific purpose by 12 European banks.

This is the third report following the inaugural issue featuring data as of June 2021 and a follow-up report featuring data as of December 2021. Now including data as of June 2022, this updated report covers one full year period for the first time.

The Evolution of Private Transaction Ratings

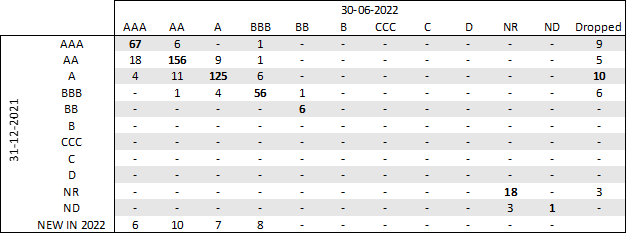

This new report includes a transition matrix, comparing the evolution of the ratings on the private transactions from Q4 2021 to Q4 2022.

Looking at the combination of Participant ID and Asset ID as a unique commitment identifier, 31 new commitments were found and 33 were dropped in the first half of 2022.

With this new approach in identifying commitments over time a migration matrix for commitments was produced.

Securitisation as a Stable and Reliable Funding Source

The matrix below shows that transaction ratings were fairly stable in the first half of 2022, and even improved somewhat. This may be due to transaction-related measures such as the increase of collateralization or an economic improvement despite the Ukraine war and the impact on energy prices.

Evolution of the Ratings on Private Transactions From 2021-Q4 to 2022-Q4

Source: Updated EBE Report

Regardless of the underlying cause, EDW believes this observation makes a strong case for securitisation as a stable and reliable funding source of the real economy.

|

DOWNLOAD REPORT

Click below to download a copy of the latest European Benchmarking Exercise report.