Everything you need to know about EDW’s Data Quality Scoring

To increase the quality and useability of loan-level data submitted to its Securitisation Repository platform, European DataWarehouse (EDW) introduced data quality scoring on a deal level in 2017.

Since then, EDW has developed and applied more than 4,000 rules and checks to both the ECB Loan-Level Data templates and the ESMA Underlying Exposures, Investor Report, and Significant Event templates.

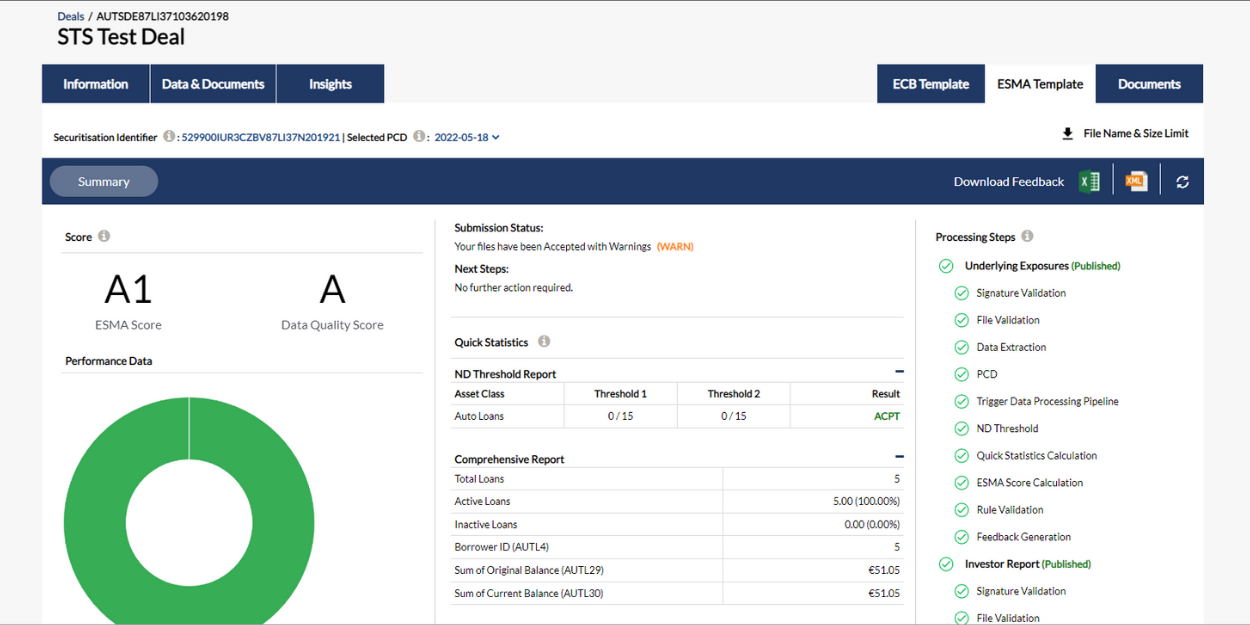

Upon a loan level data upload to EDW’s EDITOR platform, reporting entities subject their data to all of EDW’s data quality checks and are able to preview the assigned ECB/ESMA Data Quality Score (DQS) as well as detailed feedback on the loans impacted for each type of data quality check. This provides reporting entities the opportunity to resolve data quality issues in the pool and improve their DQS prior to publishing.

The EDW DQS is exclusively based on a comprehensive rule set applied to data fields of the submitted underlying exposure data.

Examples of quantitative errors include:

- Loans with Original Loan-To-Value equal to zero

- Loans with Pool Addition Date after the Maturity Date

- Unusual dates (e.g., Date of Repurchase in the future, Current Valuation Date before the Original Valuation Date)

- Decimal point issues (e.g., Interest Rate higher than 100%)

- Negative values (e.g., Default Amount, Number of Days in Arrears, Current Loan-To-Value)

- Inappropriate use of ND5 (e.g., a defaulted loan reports its default amount as ND5)

It is important to note that for ABS collateral eligibility assessment, the DQS score has no impact. There is no ‘failure threshold’ for the DQS that would lead to ineligibility of an ABS under the Eurosystem.

WHAT DOES THE EDW DATA QUALITY SCORE MEAN?

The EDW DQS is an automated score based on selected data validation rules and is a subset of all EDW-applied rules. The score is objective and provides a common basis of data quality for all deals, jurisdictions, and asset classes. It ranges from a minimum fail ratio of 0.0000% to a maximum of 0.0001% per million for an A grading to a minimum fail ratio of 4% to a maximum of 100% for an F grading.

WHEN IS THE SCORE OF A DEAL ASSESSED AND ASSIGNED?

Once data is submitted to the EDW platform, a series of automated checks are run, and a score assigned within minutes. Reporting entities are then able to see how the data quality was evaluated and which errors or red flags are present.

At this stage, it is important to note that reporting entities should upload their data by clicking “Upload” but not “Upload and Publish.” Doing so allows for the data to be evaluated and scored without being officially submitted and provides an opportunity for the data to be revised and the score improved.

HOW CAN MY DEAL’S DQS BE IMPROVED?

Resolving data issues will improve a deal’s score and EDW’s dedicated deal analysts are available to work through these issues with reporting entities on a case-by-case basis.

Once the data quality issues have been addressed, the data can be resubmitted (by clicking “Upload” only) and the improved score will be displayed.

Please get in touch with the EDW team, via enquiries@eurodw.eu or by phoning +49 (0) 69 50986 9017, for further information about the EDW DQS and for support with data submissions.