THE EVOLUTION OF ADDITIONAL CREDIT CLAIMS IN THE EUROSYSTEM:

NEW PAN-EUROPEAN CHALLENGES FOR EUROPEAN DATAWAREHOUSE

AND PEGASO 2000

In the last months, the Eurosystem has been actively implementing a series of measures to support access to credit for the real economy. The most recent measures came in with the announcement of three long-term auctions in 2021 and the extension of the Pandemic Emergency Purchase Program (PEPP) until March 2022.

The adopted measures include incentives to pledge additional credit claims (ACC) for banks. These incentives have already had relevant repercussions because they affected several dynamics:

- Halved haircuts: from 40% on average to 20%, a very significant cut that puts ACC on almost the same level as other instruments such as ABS and covered bonds;

- Reduction of the ceiling related to the probability of default: proving the opportunity to pledge loans with higher risks as collateral;

- Data reporting obligations: the eligibility criteria has been modified with the reporting frequency from monthly to quarterly to allow provide banks more time;

- New asset class: participants can now pledge in certain jurisdictions consumer credits, giving considerable support to the so-called ‘bank products’.

Many credit institutions, especially small and medium banks, have taken advantage of these favourable measures and they have either already created specific portfolios, or are planning to do so in 2021.

With regards to the reporting obligations for ACC pledging with the Eurosystem, the eligibility criteria and time estimates to be fulfilled are as follow for a generic portfolio:

- What: data collection and quality control – the necessary data quality score could be achieved in roughly three months from the selection of the performing loan;

- How: consistency between data and documentation in the IT systems – generally six months are necessary to make sure that the loan information is the same of the data included in the documentation;

- When: the first loan-level data upload in European DataWarehouse (EDW) into the EDITOR platform following the input from Pegaso 2000 ABACO CDM – one month;

- Also: additional contractual and legal hurdles – one month for the sub-scription to the EDW customer agreement.

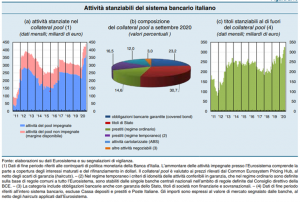

From a statistical point of view, the impact of these measures is already very relevant according to the Bank of Italy report on financial stability at the end of November 2020. The widening of assets allowed by banks and other players controlled by banks enjoy greater incentives for this refinancing channel. While these are temporary measures (some of these subordinated to the duration of the PEEP and thus valid until March 2022), the banking system is counting on further credit extensions.

The objective remains clear: continue guaranteeing a quick monetary transmission of pledges in favour of the real economy.

Chart: 2020 Composition of the Italian System Bank Collateral including ACC.

(Source: Banca d’Italia)

(Source: Banca d’Italia)

European DataWarehouse, the additional credit claims (ACC) repository for the Eurosystem, is partnering with Pegaso 2000 in an effort to affirm ACC as a pan European solution for banks to address the need for liquidity. For more information, see the recent press release from Pegaso 2000 or Bancaforte’s related article.

Media Contact:

European DataWarehouse GmbH

Diane Wathen

Marketing & Communications Manager

Tel. 49 (0) 69 50986 9326

Email: diane.wathen@eurodw.eu