DATA TIMING AND

TIMELINESS

Executive Summary:

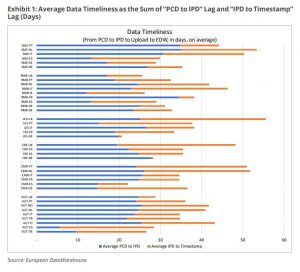

The following research report addresses the timing of data uploads. Data timeliness, as measured by the difference between the loan-level data (LLD) upload timestamp and the pool cut-off date (PCD) of the data, is key to our data users. In this paper, we measure the observed timeliness for the data submitted to our database and see how it has evolved.

We found that:

- The average reporting lag from PCD to timestamp is approximately 34 days

- There are important differences in timeliness depending on the country and asset class

- Data timeliness has not changed significantly since we started collecting data

Three dates are relevant to our data users:

- PCD, which is the “as of” date of the data

- The Interest Payment Date (IPD), which should be after the PCD

- The timestamp date, the date on which the data is uploaded

The ECB defines timeliness as part of their eligibility criteria. It specifies that following the IPD, the data provider has one month to upload the data. Furthermore, the reporting frequency should be at least quarterly, deals with monthly IPDs should report monthly, the data in the loan level data (LLD) should match that of the investor report and there should be no more than four months between two uploads.1 As a result, the LLD is typically provided to our website after the IPD, whereas the investor reports are usually made available before the IPD. As a result, there is typically a first lag from the PCD to the IPD and another from the IPD to the upload timestamp.

European DataWarehouse GmbH’s research team produces a number of annual indices and special research reports to highlight current trends in European the asset-backed security (ABS) market. The data set includes more than 2.5 billion loan-level data points from commercial mortgage-backed securities (CMBS), residential mortgage-backed securities (RMBS), small business loans, auto loans, consumer finance, credit cards and other ABS transactions.

Users can access the data on the ABS platform with European DataWarehouse’s cloud-based solutions EDITOR and EDVANCE, or a standard API interface, and analyse and compare underlying portfolios.

Data used in this research is uploaded by ABS issuers to comply with European Securities and Markets Authority (ESMA) and European Central Bank (ECB) regulatory requirements for asset-backed securitisation transactions, as well as Bank of England loan level data requirements.

For custom research reports or information on how to access the loan-level data yourself, please contact us at enquiries@eurodw.eu. Furthermore, if you have conducted research with our ABS data and would like us to feature it, please email us.