DATA AVAILABILITY REPORT Q2 2024

European DataWarehouse’s (EDW) database contains over ten years of data representing most of Europe’s public securitisations.

The Q2 2024 Data Availability Report provides quarterly statistics on the outstanding number of active securitisations, loan amounts, number of loans, and borrowers, as well as loan level data (LLD) uploads to our database.

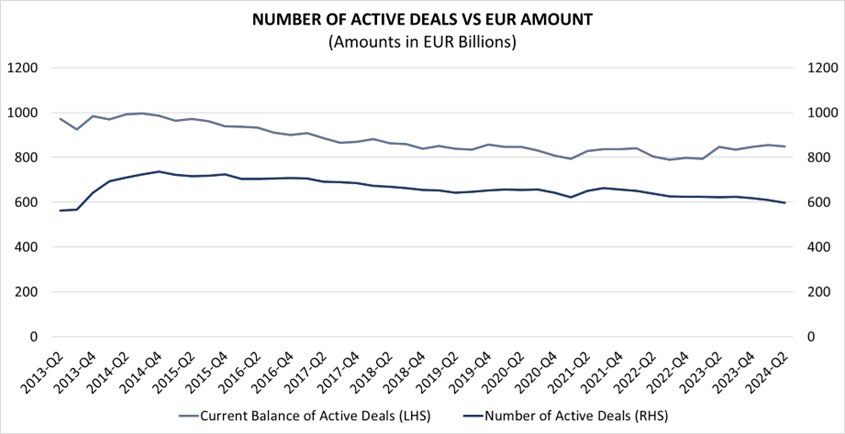

As of Q2 2024, the outstanding amount of loans uploaded to EDW totalled almost €835 billion from 12+ European countries. This value is down from a historical high of nearly €1 trillion in 2014-Q3, and has consistently been at around €835 billion since 2018-Q4 whereas the number of outstanding public securitisations is at a historical low.

The values for these loan amounts are adjusted for errors (dummy values, decimal points inconsistencies) observed in the oldest uploads. Currencies have been converted when loan amounts were reported in a currency other than the Euro.

The lesser number of outstanding deals was partly offset by the increasing size of some securitisations. The largest outstanding securitisation is now the French RMBS deal “BPCE Master Home Loans” with a €94 billion outstanding balance, which represents more than 10% of the EUR835 billion now on our platform. The largest ten securitisations on our platform account for €270 billion, almost one third of the total. These very large securitisations can typically be traced back to the largest lenders in their respective markets. That being said, not all lenders use securitisations, so that the securitised data may not always be representative of the market. Even in the largest markets (asset class / country), the share of the largest securitisation can be substantial. In France, BPCE MASTER HOME LOANS alone accounts for almost two thirds of the French RMBS universe.

Data origin by country only partially reflects the relative importance of each country in our database as securitisation is not used in all countries to the same extent. France has the largest securitisation market with an outstanding of €209 billion, Germany is second with €131 billion, and Italy third with €113 billion, ahead of the Netherlands at €108 billion and Spain with €103 billion.

Securitisation does not matter equally in all countries overtime either. While mortgage securitisations are found in most countries, not all countries are equally represented. Germany accounts for 40%+ of all auto loan amounts, and Italy for a substantial share of the consumer loans and leases (45% and 50%, respectively).

In September 2024, the last data in ECB format was uploaded to our database. Going forward, we will only receive data in ESMA / FCA format. Our “Data Input” tab shows the type of reporting used for the uploading of data to our database. During a transition phase, many deals reported to both the ECB and ESMA databases, which makes comparisons possible between both, as the ESMA and ECB formats differ on some points.

The data used for this report reflects the data transferred to our upcoming All-in-One Database (AIO), which in one database contains all the ECB, ESMA and FCA data. The data in the All-in-One Database is processed for consistency. We endeavoured to adjust the AIO data for the errors observed in the oldest uploads (dummy values, decimal point, inconsistencies). In this report, currencies are also converted when loan amounts have been reported in a currency other than the Euro. The data inventory focuses on loan-level data that is usable for research and omits some uploads whose quality we deemed insufficient (hence many pre 2013-Q3 uploads were not taken in consideration). Given that some data is uploaded either monthly or quarterly, the datasets upon which this report is based include the last available data upload for a given deal as of the end of a natural quarter (March, June, September, December).

European DataWarehouse GmbH’s research team produces a number of annual indices and special research reports to highlight current trends in the European ABS market. The data set includes more than 4 billion loan-level data points from commercial mortgage-backed securities, residential mortgage-backed securities, small business loans, auto loans, consumer finance, credit cards and other ABS transactions.

Users can access the data on European DataWarehouse’s EDITOR platform to analyse and compare underlying portfolios.

Data used in this research is uploaded by ABS issuers to comply with European Securities and Markets Authority (ESMA), European Central Bank (ECB), and Financial Conduct Authority (FCA) regulatory requirements for asset-backed securitisation transactions.

For custom research reports or information on how to access the loan-level data yourself, please contact us at enquiries@eurodw.eu. Furthermore, if you have conducted research with our ABS data and would like us to feature it, please email us.