Monitoring the Impact of COVID-19: Consumer Loan Insights

We recently looked into the payment holiday statistics for our consumer loans in our dataset. The results were discussed in our webinar on 15 December 2020. In the blog below, we discuss the insights at greater length.

Usman Jamil and Gianluca Ginelli

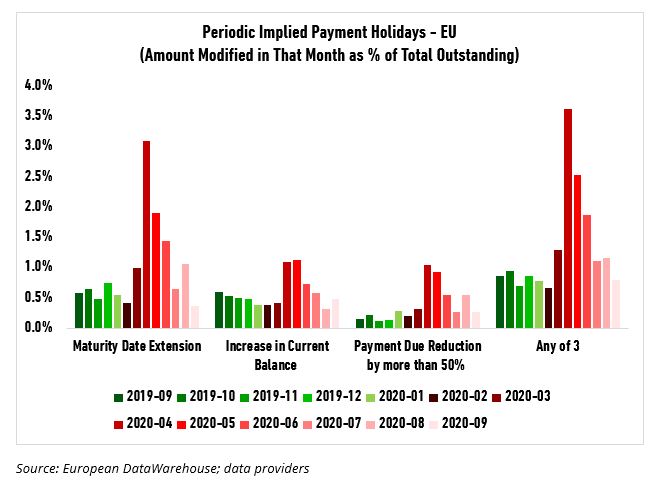

As no single field in our database fully captures the existence of payment holidays due to COVID-19, we retained three possible criteria to characterize an “implied” loan modification that could indicate a payment holiday, namely an extended maturity date, an increasing current loan balance and/or a decrease of at least 50% of the loan instalment.

- An increased maturity date

- An increasing current loan balance

- A decrease of at least 50% of the loan installment

We believe that loans where none of these three events happened prior to the COVID-19 pandemic but one or more of these events have happened since the start of the pandemic (the “any of three” category), are likely to be in payment holiday.

In Exhibit 1 we see the percentage of first-time estimated loan modifications for our consumer loans. This is calculated as the amount of modified loans in a given period as a percent of outstanding loan amounts. We can see that:

- Loan modifications existed before the crisis

- Maturity extensions seem to be the most common “payment holiday” event

- We see a surge in March, April, May 2020 (as expected)

- As of September, the number of modifications was receding towards the pre-crisis levels

Exhibit 1: Periodic Loan Modifications Peaked in March/April/May 2020

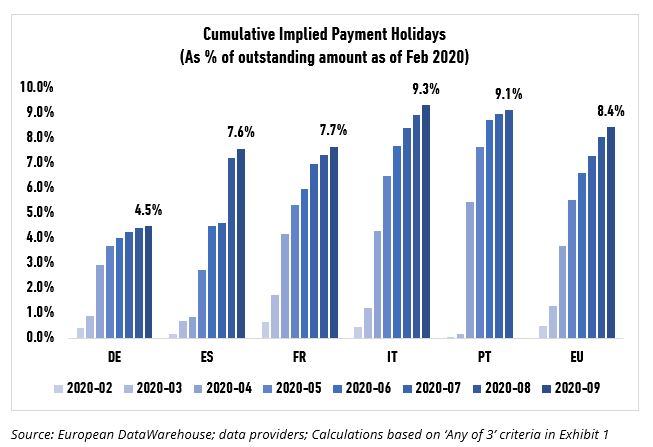

Exhibit 2 shows the cumulative amount of modified consumer loans per country. We see that all countries were not equally impacted, but the levels are actually not very far apart. Germany, which was somewhat less impacted by the first wave of COVID-19, appears to also have suffered less here. Conversely, Italy and Portugal have suffered significantly, which aligns with the severity of the pandemic in those regions.

Exhibit 2: Cumulative Implied Loan Modifications Observed in all Countries as of September 2020

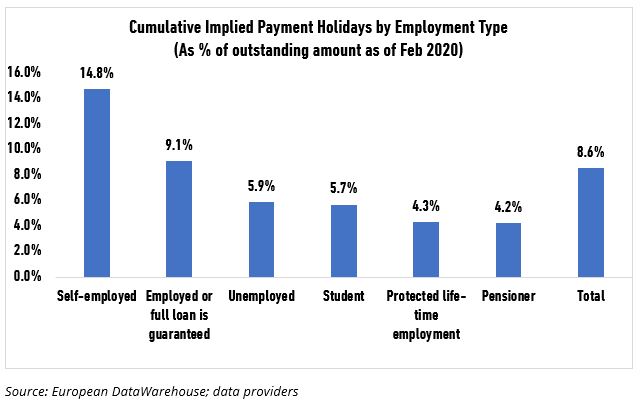

Exhibit 3 shows the same statistic per employment type. We can see that the self-employed have suffered the most and the pensioners and government employees the least. Almost 15% of the total amount of consumer loans that was lent to the self-employed in Europe as of February 2020 had had at least one loan modification.

Exhibit 3: 14.8% of Self-employed borrowers have had at least one loan modification since Feb 2020 that would imply a possible Payment Holiday

As we approach the holidays, Europe is experiencing a severe wave of the virus, compounded with a more contagious mutation. Our team will continue to monitor our data and will report on how the economic and social peril of Europe is reflected in our dataset. Please refer to our webinar archive and related research reports for more details, or contact our team at enquiries@eurodw.eu