The EU Green Bond Standard Regulation at a Glance

At the beginning of May 2023 the final consolidated text of the EU Green Bond Standard Regulation (EU GBS) was published, following the provisional agreement reached between the European Parliament and the Council of the European Union on 28 February.

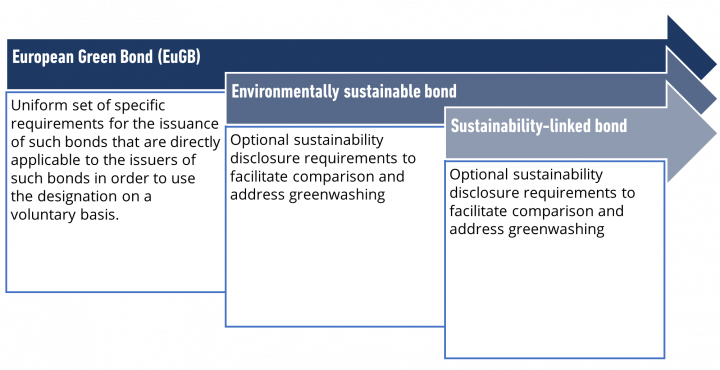

To address the challenge of diverging rules on the disclosure of information, on the transparency and accountability of external reviewers of environmentally sustainable bonds, and on the eligibility criteria for environmentally sustainable projects, the EU GBS:

- establishes uniform requirements applicable to the designation “European Green Bond” or “EuGB”

- sets the foundation for the adoption of optional pre-issuance and post-issuance disclosures for bonds marketed as environmentally sustainable and sustainability-linked bonds

- envisages the registration and supervisory framework for external reviewers

- prescribes the supervisory regime for issuers of European Green Bonds for which a prospectus is required pursuant to Regulation (EU) 2017/1129 (the “Prospectus Regulation”)

Figure 1: Overview of disclosure requirements under the EU GBS

Conditions for the use of the Designation “European Green Bond” or “EuGB”

Title II of the EU GBS outlines the requirements that a bond must meet in order to be designated as a “European Green Bond” or “EuGB.” It stipulates the only and full allocation of the proceeds of the relevant bond before its maturity must be in line with the requirements stated in Regulation (EU) 2020/852 (the “EU Taxonomy Regulation”) for:

- fixed assets that are not financial assets;

- capital expenditures falling under section 1.1.2.2 of Annex I of Commission Delegated Regulation (EU) 2021/2178 (the “Disclosures Delegated Act”);

- operating expenditures falling under section 1.1.3.2 of Annex I of the Disclosures Delegated Act -incurred more recently than three years prior to the issuance of the European green bond;

- financial assets -on the condition that those assets were created no later than five years after the issuance of the Europen green bond-; or

- to assets and expenditures of households.

A combination of any of the aforementioned allocations is also permitted for the bond to qualify as a “European Green Bond” or “EuGB”.

For certain economic activities for which there are no technical screening criteria in force under the EU Taxonomy Regulation or for certain activities in the context of international support that contribute to the environmental objectives of the EU Taxonomy Regulation, the EU GBS allows for a limited degree of flexibility.

EuGBS Applicability to Securitisation Forseen

Following the advice of the European Banking Authority (EBA) in its report on developing a framework for sustainable securitisation from 2 March 2022, the EU GBS is also expected to apply to securitisations, including that requirements on the proceeds of the bond shall be construed as requirements on the proceeds obtained by the originator from selling the securitised assets in the case of securitisations.

On top of this adjustment applicable to securitisations, the EU GBS states that bonds for the purpose of synthetic securitisation shall not be eligible to use the designation “European Green Bond” or “EuGB”.

Eu GB Transparency and External Review Requirements: Checklist for Issuers

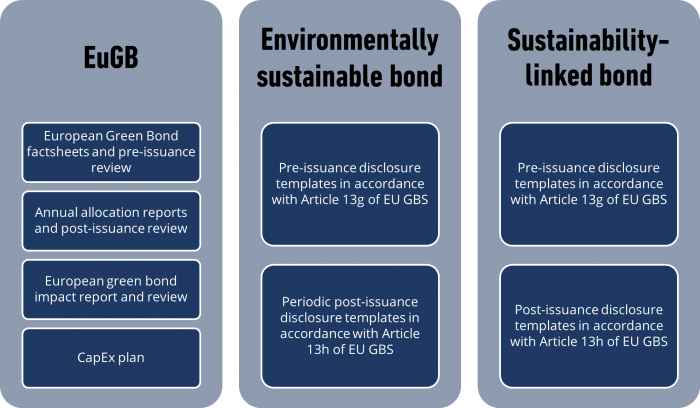

In terms of transparency and external review requirements, for bonds to be designated “European Green Bond” or “EuGB”, issuers must complete:

- the European Green Bond factsheet, and have it reviewed externally pre-issuance (Article 8 EU GBS)

- an annual proceeds allocation report, and have it reviewed post-issuance by an external reviewer after the full allocation of the proceeds of the EuGB (Article 9 EU GBS)

- the European Green Bond impact report after the full allocation of the proceeds and, at least once during the lifetime of the bond, its optional review (Article 10 EU GBS)

- a CapEx plan in accordance with Article 6 EU GBS if the use of proceeds relates to economic activities that will meet the taxonomy requirements.

In the case of securitisations, the EU GBS further requires that the prospectus shall include a statement that the bond is a securitisation bond and that the responsibility for fulfilling the commitments undertaken in the prospectus regarding the use of proceeds falls on the originator, as well as:

- (a) the share of securitised exposures in the pool of securitised exposures that finance economic activities which are taxonomy-eligible according to the Disclosures Delegated Act

- (b) the share of taxonomy aligned securitised exposures in the pool of taxonomy eligible exposures referred in point (a), per relevant economic activity listed in the Annex of the Climate Delegated Act

- where available, the share of securitised exposures in the pool of taxonomy eligible exposures referred to in point (a) that fail to meet the Do Not Significantly Harm objectives as referred to in Article 3, and point (b) of the EU Taxonomy Regulation per relevant economic activity listed in the Annex of the Climate Delegated Act.

Availability of European Green Bond Data Prescribed

The EU GBS prescribes that the additional information for securitisations shall be included in the European Green Bond factsheet and, on the basis of yearly updates to be carried out by the originator, in the European Green Bond allocation report.

The EU GBS further invites originators to make the due information available via the securitisation repositories registered with the European Securities and Markets Authority (ESMA) pursuant to Regulation (EU) 2017/2402 (the “Securitisation Regulation”).

Issuers of European green bonds shall publish on their websites and make available, free of charge and under the conditions provided for in Articles 21.3 and 21.4 of the Prospectus Regulation, the due disclosures to be eligible for the “European Green Bond” or “EuGB” designation until at least 12 months after the maturity of the bonds.

Moreover, issuers of European Green Bonds shall notify ESMA of the publication of all the information referred to in Article 13 EU GBS within 30 days and, where applicable, shall likewise notify the competent national authority according to Article 36 EU GBS of the publication for each of the due documents without undue delay following each publication.

Optional Disclosures for Bonds marketed as Environmentally Sustainable and Sustainability-Linked Bonds (Title IIa EU GBS)

The EU GBS aims to tackle the lack of common and standardised European disclosure templates for issuers of environmentally sustainable bonds or sustainability-linked bonds and the subsequent barriers for investors to easily and reliably locate the information they need and to compare and aggregate data on those bonds. It does so by means of proposing voluntary disclosure templates for issuers to complete and publish alongside their other disclosure documentation.

In this sense, the EU GBS envisages the publication of guidelines by the European Commission (via a European Commission Communication) establishing voluntary templates for pre-issuance disclosures (Article 13g EU GBS) and common templates (via European Commission delegated acts) for periodic post-issuance disclosures for issuers of bonds marketed as environmentally sustainable or sustainability-linked bonds (Article 13h EU GBS).

The EU GBS advises that ESMA, as a body with highly specialised expertise, is entrusted with the development of the delegated acts (draft regulatory and implementing technical standards) that do not involve policy choices.

The optional disclosures should be consistent with the relevant sections of the European Green Bond factsheet and allocation report.

Figure 2: Detailed disclosure requirements under the EU GBS for EuGBs, environmentally sustainable and sustainability-linked bonds.

The supervisory regime ensuring compliance by the different obligated entities with their respective duties under the EU GBS is assigned to national competent authorities or ESMA according to their corresponding mandates and in consistency with the correlated regulations, i.e., the Prospectus Regulation, the Securitisation Regulation.

Ongoing Reviews of European Green Bond Standard on the Horizon

The application of the EU GBS should be reviewed by the European Commission five years after its entry into force, and every three years thereafter, based on the input from the Platform on Sustainable Finance and ESMA, where relevant, with the purpose of evaluating, amongst other things:

- the uptake of the European Green Bond Standard and its market share, both in the Union and globally, and in particular by small and medium sized enterprises;

- the impact of this regulation on the transition to a sustainable economy, on the gap of investments needed to meet the Union climate targets as set out in Regulation (EU) 2021/1119 (European Climate Law), and on redirecting private capital flows towards sustainable investments

- the practical impact of provisions in Article 4a on the use of European Green Bonds and the environmental quality of the proceeds. This report shall also justify whether the provisions do not prevent the transition towards the financing of environmentally sustainable activities

- the implementation of the optional disclosures for bonds marketed as environmentally sustainable and sustainability-linked bonds, including the use of the templates among issuers of bonds in the EEA and outside the EEA. The report shall analyse the take-up of the templates, the evolution of the market, and their consistency with other relevant legislation, including Regulation 2019/2088 (SFDR).

Three years after the entry into force of the EU GBS, the European Commission should also produce a report assessing the need to regulate sustainability-linked bonds. By the end of 2024 and every three years thereafter, the European Commission should additionally produce a report on the review of the technical screening criteria as foreseen in the EU Taxonomy Regulation.

By five years after the entry of the EU GBS and, where appropriate, every three years afterwards, the Joint Committee of the ESAs shall publish a report on the evolution of the market for securitisation bonds. The report shall, in particular, assess whether the volume of taxonomy-aligned assets eligible to be securitised has increased sufficiently over that period to revisit the application of the use of proceeds rules to securitisation bonds.

After five years of EU GBS’s entry into force, EBA, in close cooperation with ESMA and EIOPA, shall publish a report on the feasibility of extending the eligibility to use the designation “European Green Bond” or “EuGB” for the purpose of synthetic securitisations.

European DataWarehouse provides an IT solution allowing certain securitisations to adhere to the EU GBS.