IRPH Index: Insight from European DataWarehouse

On the 10th of September 2019, the Advocate General of the Court of Justice of the European Union published a ruling against Spanish banks1

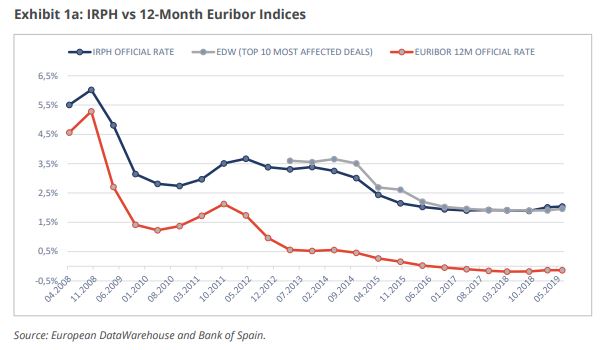

which used the Indice de Referencia de Préstamos Hipotecarios (IRPH) as a reference index for the mortgages they offered in the last decades2. The ruling stated that this index, which was found to lack overall transparency, could be considered abusive if borrowers were not made aware of its composition and historically higher rates compared to other indices, as shown in Exhibit 1a.

In the ECB RMBS reporting template, the interest rate index is reported in field AR108. Unlike the Euribor indices, the IRPH does not have a dedicated number for field AR108. We have found that IRPH is likely to be the only index referred for Spanish deals when AR108 (Current Interest

Rate Index), is populated with ‘’13’’ (Other). To confirm if the IRPH is used in a given deal, one must also refer to deal documentation, commentaries or investor reports. Furthermore, some data providers have informed us that indeed, ‘’13’’ in field AR108 refers to the IRPH.

As of the second half of 2019, we found that:

- 68% of our active Spanish RMBS deals had at least 1 loan indexed to the IRPH, and

- 7.5% of total active Spanish RMBS loans on our platform are indexed to IRPH

Based on our data, we see that, historically, IRPH-linked interest rates have been higher than those linked to Euribor. Even considering

the spread, there is still a substantial difference, as shown in Exhibit 1b. For example, a 20-year EUR 150,000 mortgage issued in Q1 2014 linked to the IRPH would have exceeded EUR 5,000 in additional costs compared with a loan linked to 12-month Euribor by Q1 2019.3,

European DataWarehouse GmbH’s research team produces a number of annual indices and special research reports to highlight current trends in European the asset-backed security (ABS) market. The data set includes more than 2.5 billion loan-level data points from commercial mortgage-backed securities (CMBS), residential mortgage-backed securities (RMBS), small business loans, auto loans, consumer finance, credit cards and other ABS transactions.

Users can access the data on the ABS platform with European DataWarehouse’s cloud-based solutions EDITOR and EDVANCE, or a standard API interface, and analyse and compare underlying portfolios.

Data used in this research is uploaded by ABS issuers to comply with European Securities and Markets Authority (ESMA) and European Central Bank (ECB) regulatory requirements for asset-backed securitisation transactions, as well as Bank of England loan level data requirements.

For custom research reports or information on how to access the loan-level data yourself, please contact us at enquiries@eurodw.eu. Furthermore, if you have conducted research with our ABS data and would like us to feature it, please email us.