Auto ABS in Focus: Comparing Loans vs Leases and Captives vs Non-Captives

During European DataWarehouse’s 2025 Q3 Research Update Webinar, the differences between auto ABS portfolios of loans vs leases, and assets originated by captives versus non-captives were discussed. Several charts were published to demonstrate the prevalence of the various categories of deals across countries and to explore whether any differences in performance could be observed.

The analysis explored how these distinctions affect performance across European markets and led to the publication of a comprehensive classification list of auto ABS transactions — available for DOWNLOAD HERE.

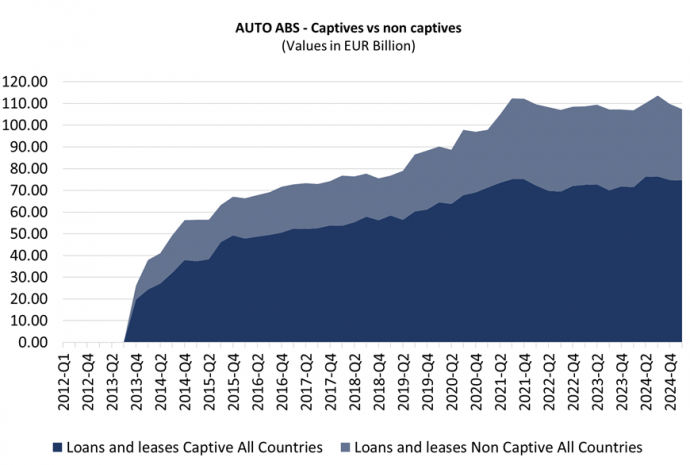

Growth of the Auto ABS Market

The auto ABS segment has expanded substantially since 2013 (Exhibit 1), reaching approximately. EUR 107 billion outstanding as of Q4 2024.

Exhibit 1: Auto ABS Outstanding Captive vs Non-Captive

Source: European DataWarehouse; public securitisations only

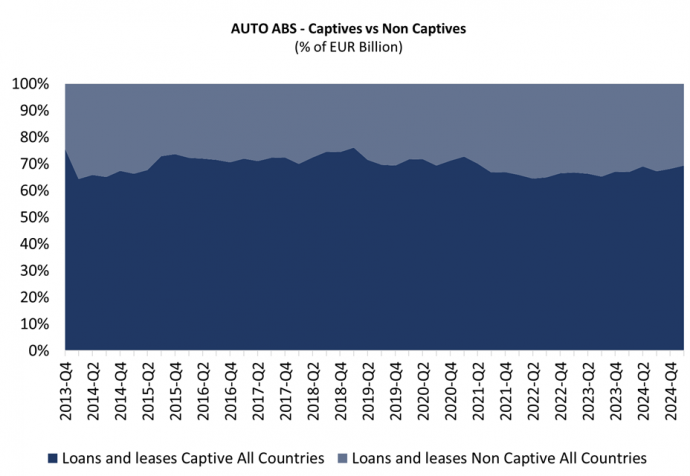

Understanding Captive and Non-Captive Financing

Auto financing can be provided by non-captive lenders, such as banks, fintechs, or the lending subsidiaries of insurance companies, or by captive lenders, which serve the auto financing arms of auto manufacturers.

The key distinction lies in purpose: captive lenders support the manufacturer’s sales strategy, offering tailored financing conditions (such as 0% interest loans or other promotional rates) to boost vehicle sales and overall profitability. While total securitised volumes have increased steadily since 2013, the share of captive-originated financing has remained steady at around 70% over time.

Exhibit 2: Auto ABS Outstanding Captive vs Non-Captive (Percentage)

Source: European DataWarehouse; public securitisations only

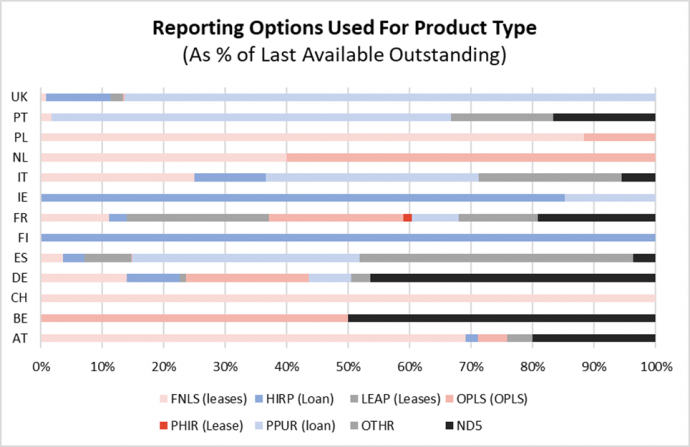

How to Identify Loans and Leases in ESMA Reporting

Auto securitisations typically contain only loans or leases, but distinctions can be unclear. The ESMA field AUTL23 (“Product Type”) helps identify product types, including:

- Finance Lease (Lease- FNLS): a contract between customers and the equipment suppliers for using a particular asset against periodic payments.

- Lease Purchase (Lease – LEAP): also known as a lease purchase agreement or rent-to-own agreement. It allows consumers to obtain durable goods or rent-to-own real estate without entering into a standard credit contract.

- Operating Lease (Lease – OPLS): a lease in which the lessee obtains the right to use an asset for a period of time, without transferring the significant risks and rewards of ownership or the underlying asset itself.

- Personal Contract Hire (Lease – PHIR): a type of long-term vehicle leasing agreement for private individuals.

- Hire Purchase (Loan – HIRP): a type of asset finance that allows firms or individuals to possess and control an asset during an agreed term. Instalments/rents cover the depreciation of the asset, as well as interest required to cover the capital cost of the asset. The asset owner transfers ownership rights once all instalments have been covered.

- Personal contract purchase (Loan – PPUR): often referred to as a personal contract plan, it is a form of hire purchase vehicle finance for individual purchasers, combining features of both personal contract hire and traditional hire purchase (buying through instalments).

As shown in Exhibit 3, the mix of products used differs widely across countries. Personal contract purchase is the most common financing in the UK. In the Netherlands, only leases are used. In France and Germany, a greater variety of products is used. It is important to stress, however, that our statistics only represent loans/leases that are securitised.

Exhibit 3: Product Type Prevalence in European Auto ABS Using ESMA reporting

Source: European DataWarehouse

Notably, the ND/OTHER category accounts for up to half of the cases in Spain, Germany, Belgium, and represents a sizeable portion in Portugal, Italy, France, and Austria. In most instances, these ND/OTHER options, used in AUTL23, refer to loans that do not fully correspond to the options described above, with many likely representing standard consumer loans.

Captive Financing Shows Stronger Performance

Data from multiple markets suggests that captive-originated assets tend to perform better than those from non-captives. The relationship between loans and leases, however, is more nuanced and varies by country. Refer to the slides of the Q3 Research Update Webinar for more details.

Exhibit 4: Germany Auto ABS Performance by product and originator type

Source: European DataWarehouse

The distinctions between loans and leases, and between captive and non-captive originators, play a key role in understanding performance trends in the European Auto ABS market. Please refer to the EDW Insights page to explore many other articles, reports, and blogs relating to this topic or get in touch by emailing enquiries@eurodw.eu.