A Year in Review: European Datawarehouse Continues its Efforts on the Green Auto Securitisation Project

After more than a year since the kick-off of the Green Auto Securitisation (GAS) project, European DataWarehouse (EDW) is taking stock of the advancements made in assessing the sustainability of the European car industry.

GAS, a collaborative project driven by EDW and the Leibniz Institute for Financial Research SAFE and funded by the German Federal Ministry for Education and Research under the Climate Protection and Finance (KlimFi) initiative, aims to provide insights for the design of future sustainable auto policies and their impact on the risk management of European financial institutions. The project is based on an empirical analysis of securitised auto loans and leases (Auto ABS) regarding sustainability-related data, residual values of vehicles, and credit risks in Germany, France, and Spain.

ENERGY PERFORMANCE CERTIFICATES FOR CARS SET TO INCREASE

As a registered EU securitisation repository, EDW continues to receive loan-level information on public auto and leasing transactions via the ESMA disclosure templates.

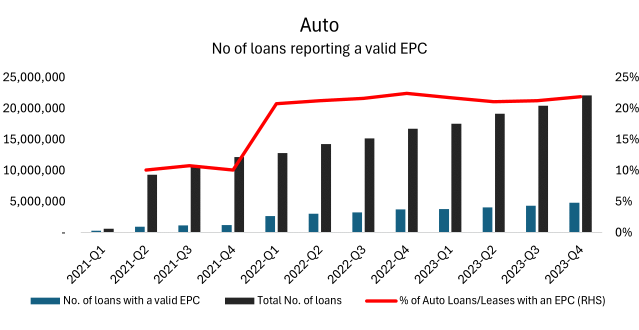

According to EDW data, the number of valid energy performance certificates (EPCs) has steadily increased to 4.8 million as of Q4 2023 (Figure 1). This shows a positive trend towards sustainability disclosure in the context of securitised portfolios.

Figure 1: Total Cumulative Auto Loans with a Valid EPC Reported to the EDW Platform

Source: European DataWarehouse

BEYOND THE EPC: ESTIMATING CO2 EMISSIONS FROM THE EUROPEAN ENVIRONMENTAL AGENCY DATABASE

The EPC, despite providing a concrete indication of the energy performance of a car, is not standardised at the European level due to the different calculation methodologies used by each jurisdiction. To overcome this challenge, and to further enrich the EDW auto and leasing dataset with climate-related indicators, we continued the work started in 2022 to standardise manufacturer and model-related information.

Thanks to data cleansing efforts we can now match credit information contained in the EDW platform with climate fields from the European Environmental Agency (EEA) database. The EEA is the agency of the European Union which collects and validates sustainability-related data from various sources in a standardised and consistent manner.

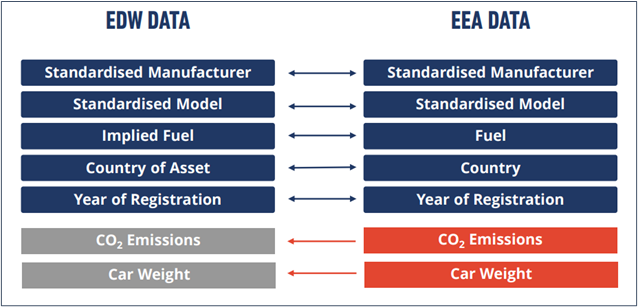

The enriched dataset contains, among other information, the CO2 emissions from all new passenger vehicles sold in Europe. The key identifiers used by the EEA are type/approval/number and type/variant/version methods. Whilst the ESMA templates do not contain such identifiers, we imply the fuel type of the car based on the standard manufacturer and model data. Together with the country of the asset and the year of vehicle registration, a unique dataset is created, connecting credit and sustainability-linked information based on the key identifiers reported in Figure 2.

Figure 2: Estimating CO2 emissions in Auto ABS

Source: European DataWarehouse

In the diagram above, identifiers matching the information from EDW to EEA are highlighted in blue, whilst information on CO2 emissions and vehicle weight retrieved from the EEA database to enrich EDW credit data are highlighted in red.

ESTIMATING REAL TIME DELINQUENCY INFORMATION BASED ON CO2 EMISSION BUCKETS

Thanks to the methodology described above we are able to study the credit performance of loans for different vehicle fuel types.

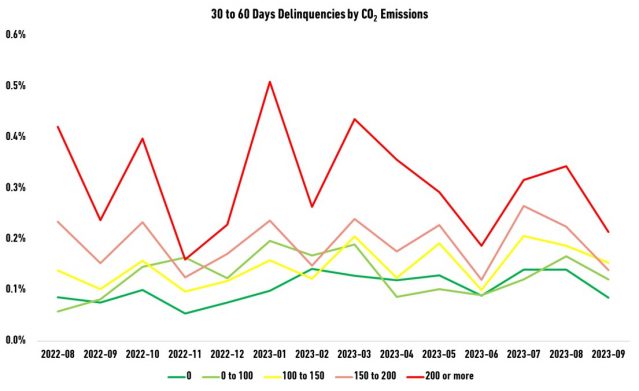

In fact, Figure 3 shows that less efficient vehicles have higher delinquency rates compared to more efficient vehicles when considering CO2 emissions.

Figure 3: Loan Delinquencies by CO2 Emission Buckets

Source: European DataWarehouse

The studies conducted in 2023 as part of the GAS initiative lay the groundwork for advancing intelligence gathering on the green auto loan and leasing markets in Germany, France and Spain , aligning with the overarching objectives of the EU Green Deal.

EDW, in collaboration with the Leibniz Institute for Financial Research SAFE, held the second ‘Driving the Future: European Green Auto Securitisation Workshop’ on 12 November 2024 in Frankfurt where regulators, investors, rating agencies, and other market participants met to discuss the future of the automotive industry in the context of sustainable finance.

More specifically, participants engaged on the best way forward to build incentives that reduce vehicle emissions via use of proceeds in a potential combination with green loans according to the latest recommendations from the ESAs. For further insights, download the GAS workshop presentation here.