ECB and ESMA Data in Use – A Snapshot of Moratoria in SME Loans

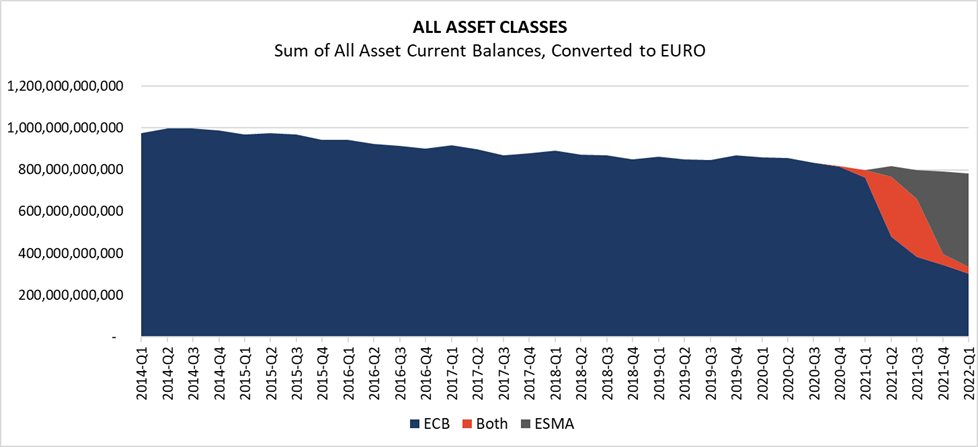

The outstanding amount of the public loans in European DataWarehouse’s (EDW’s) Securitisation Repository platform has stood consistently around +/- EUR 800 billion since Q4 2020.

Following the registration of the first Securitisation Repositories by the European Securities and Markets Authority (ESMA) in June 2021, reporting entities have been obligated to report all STS securitisations, as well as securitisations that closed after 2019, to ESMA.

Since then, a growing number of reporting entities have switched from European Central Bank (ECB) to ESMA reporting templates. ECB reporting will be phased out in 2024 for repo eligible securitisations.

In the case of some deals, EDW has data reported both in ESMA and ECB format for the same quarter.

Sum of all Asset Current Balances, Converted to EURO

Source: European DataWarehouse

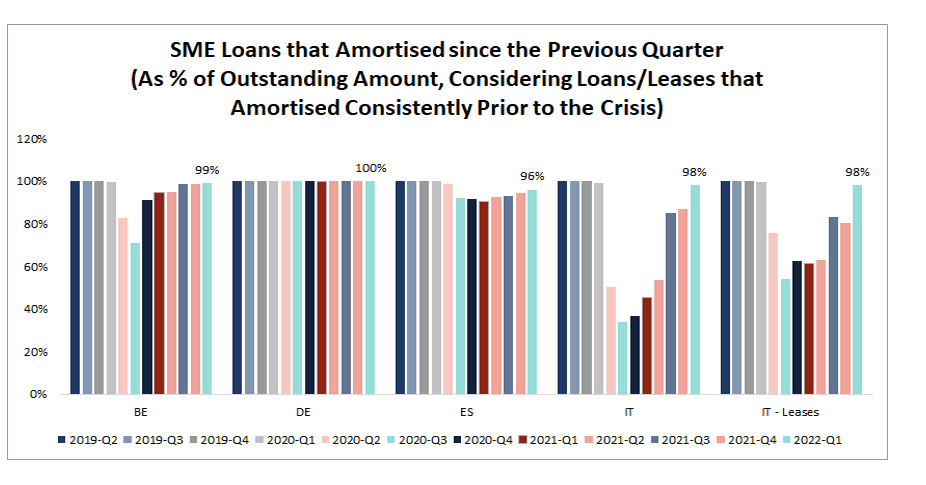

EDW previously illustrated the persistence of moratoria across other asset classes in its New Year Research Update which took place in February 2022.

Now, for the first time, a combination of both ECB and ESMA data has been used to update an analysis of SME loan amortisation patterns. To do so, a dataset was selected based on all loans with identifiable IDs over time in both reporting formats which had also consistently amortised prior to COVID-19.

The ratio of loans that amortised since the previous period against the total outstanding amount was also calculated. Such analysis is only feasible in the cases where the same loan identifiers are used upon switching from the ECB to ESMA reporting format.

Thanks to this unique combination of data, we can see that most of the SME loans that were amortising prior to COVID-19 have returned to previous amortisation patterns.

SME Loans that Amortised Since the Previous Quarter

Source: European DataWarehouse

For further information about the availability of ECB vs ESMA data on EDW’s EDITOR platform, please refer to the slides from our Spring Research Update.

To stay up-to-date with the latest regulatory developments in the securitisation market, EDW product updates, ABS research insights, and upcoming workshops & events, please subscribe to our mailing list.