ECB-ESMA Reporting Overlap Helps Data Interpretation

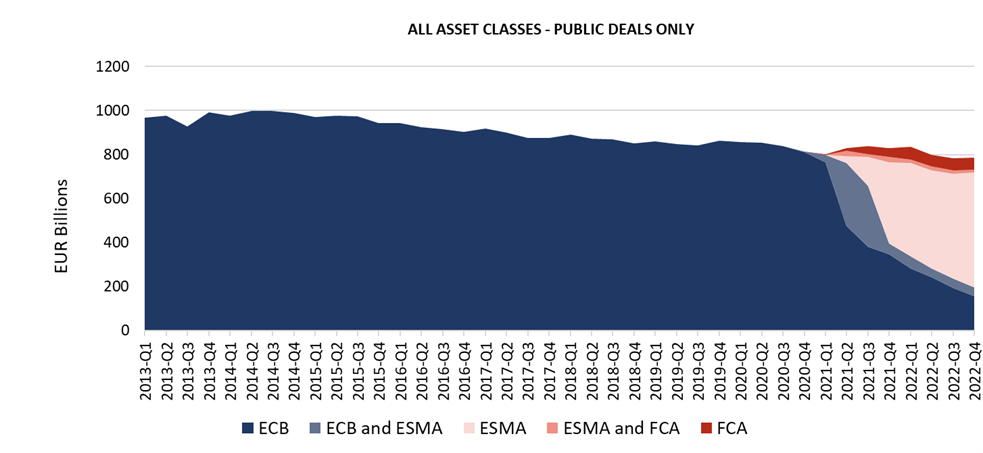

As a result of regulatory changes , EDW data is available on three different databases (ECB, ESMA and FCA) using two reporting formats.

This can make time-series-type work challenging. Indeed, our original ECB database uses the ECB reporting format and hosts historical data from 2013 onward, whereas recent uploads are mostly in our ESMA database which uses a somewhat different ESMA reporting format; the latter will ultimately replace the ECB format from October 2024 onwards.

As a consequence of Brexit, we also manage a UK database, which uses the ESMA-like FCA format (see Exhibit 1). The ESMA reporting format was originally based on the ECB format but differs in that some fields were added, dropped or have a modified definition or different lists of options.

When both an ECB and an ESMA upload are available for a given deal for the same period, it becomes possible to see how the ECB template information was translated to the ESMA format for these deals. In some cases, the ECB historical data and the ESMA data can even complete each other. We highlighted this in our September 2022 Research Webinar (slides 25-27), where we used deals for which energy efficiency labels were reported in ESMA and for which the loan identifiers were the same in ECB and ESMA to show historical arrears, grouping loans by energy efficiency category.

Exhibit 1: EDW Data Is Available in 3 Separate Databases

Source: European DataWarehouse

To measure the data reporting overlap, we compare the latest reporting date available in the ECB database to the earliest reporting date for a deal in the ESMA database. Such overlaps constitute the categories “ECB and ESMA” and “ESMA and FCA” in Exhibit 1.

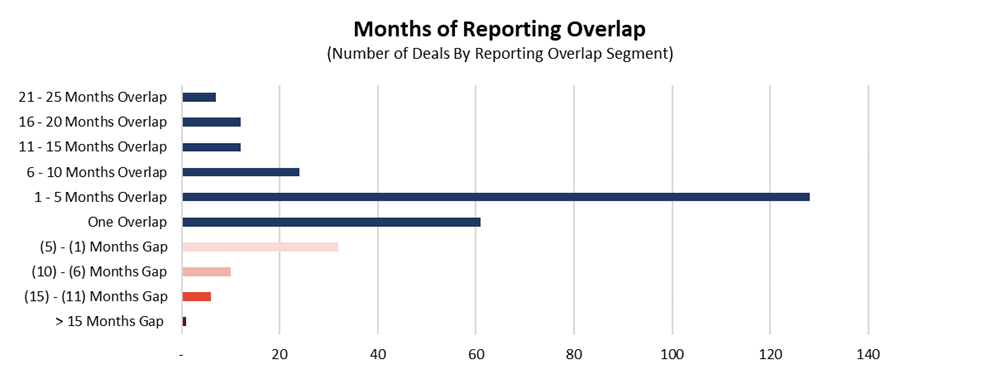

- If the first ESMA reporting date coincides exactly with the last ECB reporting date, it means that there is exactly one period for which the ECB and ESMA data can be compared, one overlap (Exhibit 2).

- If the first ESMA reporting date precedes the last ECB reporting, it means that there are possibly many overlaps.

Overlaps generally occurred when data providers started to upload ESMA data but encountered data quality issues. In these cases, many organisations continued to upload ECB data as well as ESMA data. When both ECB and ESMA data are available, we would expect the ECB upload to have better data quality than the ESMA upload.

In the United Kingdom, loans almost always have a short fixed-rate period with a switch to floating rates afterwards.

Exhibit 2: ECB vs ESMA/FCA Reporting Overlap in Months

Source: European DataWarehouse; (overlap in blue, gap in pink/orange)

Exhibit 2 shows that:

- There are 128 deals for which the overlap is 1 – 5 months, meaning that there are 1 or 2 overlapping uploads (if uploads are quarterly) for these deals.

- For 7 deals, data has been reported both in ECB and ESMA formats for more than 20 months.

For some deals, the overlap is negative, “a gap”. When the gap is between 0 and 3 months (this is the case for 26 deals), this typically means that there is no ECB/ESMA overlap, and that one submission was uploaded in the ECB database and that the next one was uploaded in ESMA format.

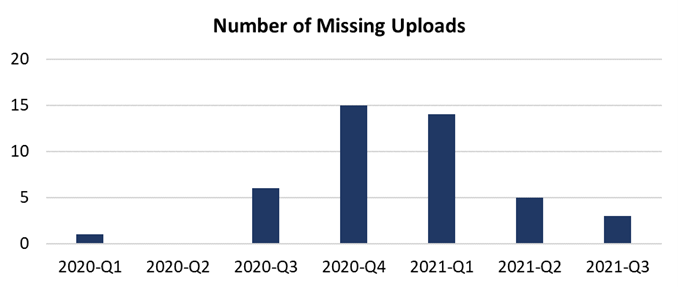

There are 23 deals, however, where the gap exceeds 3 months, which means that there is a period during which data was not uploaded in ECB or in ESMA format. We counted at least 44 such missing uploads, of which 30 for the UK and 7 for Ireland; 29 of these missing uploads are in the RMBS asset class and 11 in the Auto asset class. The missing uploads are concentrated in the quarters 2020-Q3 to 2021 Q2 (Exhibit 3). This corresponds broadly to the transition period starting when the ESMA reporting format became mandatory (September 2023) to the period when EDW became a Securitisation Repository under ESMA (June 2021). These “missing uploads”, can almost all be found in XML format in our EDITOR platform in the “underlying Exposures” section.

Exhibit 3: Most Missing Uploads Are in 2020-Q3 to 2021-Q2

Source: European DataWarehouse

Our upcoming All-in One Database will merge all these data sources in one to make time-series type work easier; Please refer to our last Research webinar (available as an archived event dated 26 September 2023) for more information.