ESMA vs. ECB Reporting Formats: What You Need to Know

As of 1 October 2024, all eligible ABS issuers must provide loan-level data using the templates specified in the technical standards adopted by the Commission under Article 7(4) of Regulation (EU) 2017/2402 (the Securitisation Regulation). These templates are commonly referred to as the “ESMA templates”. The specific template to be used in each case depends on the type of asset backing the ABS.

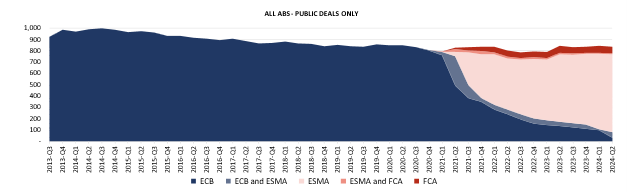

The use of the ECB reporting template thus stopped in Q4 2024. Since then, data has been uploaded to EDW using the ESMA or FCA reporting formats only. This marks the end of a transition period which started in 2021 with the introduction of the ESMA templates. Exhibit 1 illustrates the progression of data reporting across these formats over the years. 129 of the legacy public deals that were using the ECB reporting format at the beginning of 2024 have now switched to the ESMA format.

Exhibit 1: ESMA vs ECB vs FCA Reporting Format Use in EDW

Source: European DataWarehouse

To assist data users in accessing and interpreting historical ECB data, the taxonomies defining the ECB and ESMA dataset fields respectively can be downloaded here:

Access ESMA Templates

Download ECB Templates

ESMA and ECB data must therefore be combined to do time series analyses. The ESMA and FCA formats, differ substantially from the ECB templates. We note that the ESMA templates mention which ECB field is replaced by which ESMA field (although the replacement is not always a 1 to 1 fit). The preservation of the time series therefore depends on the fields that ECB and ESMA have in common. Some of the fields of the ECB template were mandatory and had to be populated to maintain eligibility, with a “comply or explain” principle allowing counterparties to provide explanations if certain mandatory data could not be submitted.

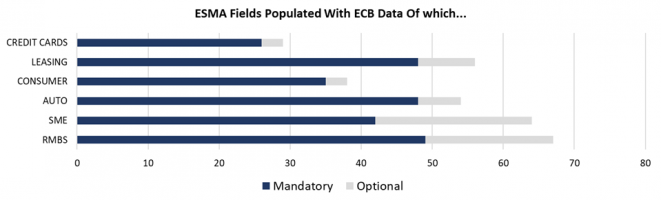

Exhibit 2 shows that ECB fields with an ESMA equivalent are mostly mandatory fields (such as origination date, loan amount etc.). ECB mandatory fields had to be populated whereas optional fields were often not populated in the ECB database.

Exhibit 2: ECB Fields With ESMA Equivalents Are Mostly Mandatory Fields

Source: European DataWarehouse

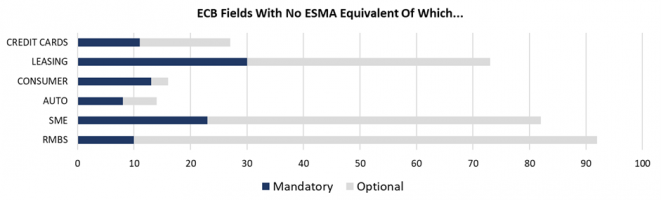

In contrast, ECB fields with no ESMA equivalent are mostly optional fields (Exhibit 3). Optional ECB fields are fields that were mentioned in the methodology of at least one of the rating agencies and which could be used for credit analysis. In practice, these fields were not often populated.1

Exhibit 3: ECB Fields With No ESMA Equivalent Are Mostly ECB Optional Fields

Source: European DataWarehouse

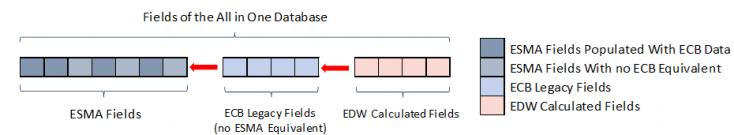

The recent switch to ESMA reporting thus makes time series analyses challenging. European DataWarehouse (EDW) is working on a beta version of its All-in-One database (AIO), which merges ECB and ESMA data and thus preserves the time series from Q2 2013 to Q4 2024, for the six main asset classes. It will facilitate time series analyses, given that the historical data is mostly in ECB format and that the new data is mostly reported in ESMA format. It will also improve user experience in other ways:

- It benefits from the work done for the Adjusted ECB Database2; whereas data quality errors remain in the main databases3, we endeavour to correct them in AIO.

- AIO is structured so that all the ESMA fields and all the ECB fields are included to avoid information loss.

- We optimised field size and format to simplify queries and (hopefully) make them faster. Among other improvements, the number fields are already “CAST AS NUMBER” in the AIO.

- Lastly, it also contains “calculated fields”, that make it more user-friendly.

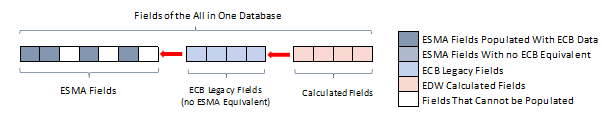

AIO contains all the ESMA fields, to which we add the ECB fields without ESMA equivalents, plus calculated fields.

Exhibit 4a: Composition of the “All-in-One” Database

Source: European DataWarehouse

When ECB data is imported in AIO, the ESMA fields for which there is no ECB equivalent cannot be populated (Exhibit 4b). The ECB fields with no ESMA equivalent (i.e. ECB legacy fields) will be populated if they were already populated in the ECB database. Typically, not all will be populated as many of these legacy fields were optional in the ECB taxonomy and were therefore often not populated. The calculated fields are then populated when there is sufficient information.

Exhibit 4b: When ECB Data is Imported into Our “All-in-One” Database

Source: European DataWarehouse

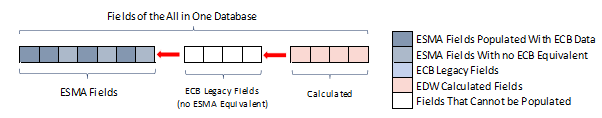

When ESMA data is imported, all the ESMA fields will be populated, whereas ECB legacy fields cannot be populated (Exhibit 4c). The calculated fields will still be calculated based on the available ESMA data.

Exhibit 4c: When ESMA or FCA Data is Imported into Our “All-in-One” Database

Source: European DataWarehouse

At present, the beta version AIO contains ECB data as well as the ESMA data up to Q4 2024. We have been using it regularly to produce material for our research webinars. Stay tuned for more!

1See our report on optional fields More is Better: Optional Loan Level Data Fields Provide Valuable Complementary Information

2See our Adjusted Database Methodology

3We check data quality and flag errors to data providers but we are not allowed to correct these errors ourselves in the main databases, hence the need for a specific adjusted database.