Understanding EDW’s Loan Identifier Reoccurrence Score

Following EDW’s recent Q1 Research Update Webinar, in which the topic of loan ID consistency was discussed, the company is pleased to publish its Loan Identifier Reoccurrence Report.

The excel report lists Reoccurrence Scores for the loan IDs, borrower IDs, and property IDs for all public securitisation EDCODES using ECB reporting until Q4 2022.

LOAN AND BORROWER ID CONSISTENCY NOW MORE EASILY IDENTIFIED

EDW’s Reoccurrence Score indicates the proportion of a specific identifier reported at T+1 that was already reported at T0. For instance:

- A score of 100% implies that all of the identifiers provided in the T+1 data upload were already provided in the upload at T0

- A score of 0% implies that none of the identifiers provided in the T+1 data upload were already provided in the upload at T0

- A score of 99% implies that all but 1% of the identifiers provided in the T+1 data upload were already provided in the upload at T0

Such a list can make it easier for data users to identify the EDCODES and time series for which these loans and borrower identifiers have been reported consistently (100%).

Conversely, when this is not the case, EDW invites data users to look into the characteristics of the loans with a new identifier at T+1.

Insights into Possible ID Inconsistencies

When the Loan Identifier Reoccurrence Score is not 100%, possible causes include:

Revolving Deal

It is possible that the new identifiers correspond to loans that were added since the previous period as is the case for Geldilux-TS-2015 S.A. (SMESLU000556100220152).

The score is extremely low for the loan identifier AS3, because the loans are very short term. The score is somewhat higher for borrower IDs (AS7) as borrowers tend to be represented overtime in the portfolio by new short-term loans.

Loan Status Change

When all the “new” loan IDs correspond to loans that are systematically in arrears or defaulted, it’s possible that loan IDs are modified upon hitting delinquency or default status.

In some Dutch RMBS deals, upon default, loan parts can be aggregated into one defaulted loan, eventually under a new loan ID.

Systematic Change

In other cases, all the loan IDs change from one period to the next. This can happen for various reasons, ranging from the suppression of leading or trailing characters to a systematic change following a bank merger/acquisition or some kind of internal reorganisation.

The Evolution of ID Reporting Consistency

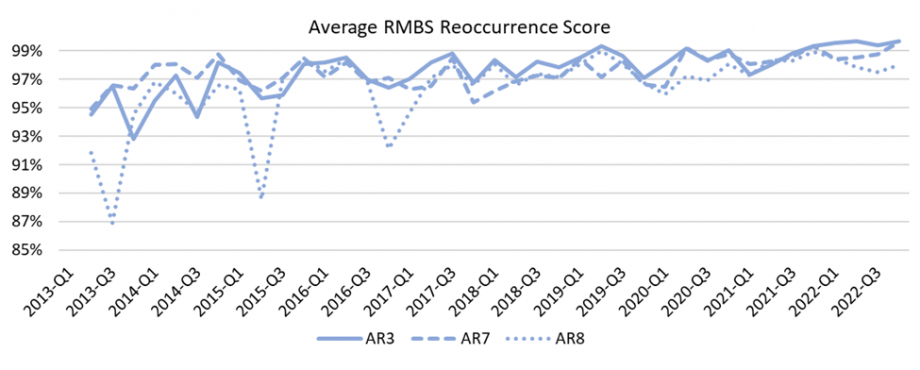

For RMBS deals, ID reporting consistency has improved over time, as shown in EXHIBIT 1 below.

Exhibit 1: Evolution of the Average Reoccurrence Scores for RMBS

Source: European DataWarehouse

EDW’s Loan ID Reoccurrence Score is a traceability score rather than a data quality score, and a change of ID is not necessarily a data quality error. For instance, as per the ECB taxonomy for RMBS, loan ID changes were acceptable as long as the new ID featured the old ID followed by the new ID and comma separated. This requirement was often not applied.

When a loan ID changes for a given EDCODE+PCD, EDW encourages users to check if the borrower ID changes as well. When this is not the case, the borrower ID completed by other static loan characteristics (such as loan rank or origination date) may make loan tracking easier.

Loan and Borrower ID reporting consistency matters when loans are tracked over time, as is the case when performing certain defaults, recovery, and prepayment calculations.

In summary, the reports tracks the reoccurrence of 13 identifiers for 6 asset classes for all public deals from 2013 to 2022.

For each asset class, the ECB taxonomy has a loan identifier and a borrower identifier; RMBS also has a property identifier.

The calculations are based on EDW’s Adjusted Database, in which the identifiers have not been modified until now, but from which some submissions were excluded due to data quality issues.