Updated GAP Analysis on the EBA NPL Transaction Data Templates

Article 16 (1) of the Directive (EU) 2021/2167 on credit servicers and credit purchasers mandates the European Banking Authority (EBA) to develop a set of common data standards for the sale or transfer of non-performing loans (NPL) that would enable cross country comparison and reduce information asymmetries between buyers and sellers. Those were perceived by regulators as the main obstacles in developing an efficient secondary market for NPLs.

In December 2022 EBA published its final report on the draft implementing technical standards (ITS) specifying the templates to be used by credit institutions for the sale or transfer of non-performing loans to credit purchasers. The draft ITS have been subsequently submitted to the European Commission for its adoption as a key pillar of Directive (EU) 2021/2167, which will need to be transposed into national law by the single member States.

As per the final report, the draft ITS are based on the disclosure of loan-level information, covering data fields on the counterparties related to the loan, contractual characteristics of the loan, any collateral and guarantee provided, any legal and enforcement procedures in place, and the historical collection of loan repayment.

The templates shall be used for transactions relating to credits issued on or after 1 July 2018 that become non-performing after 28 December 2021, not included in securitised portfolios.

Alignment of best practice with due diligence requirements

Following the public consultation on its NPL transaction data templates launched in May 2022, EBA further streamlined the data fields, aligning the templates with best market practices whilst still providing potential buyers with the necessary dataset for their portfolio due diligence.

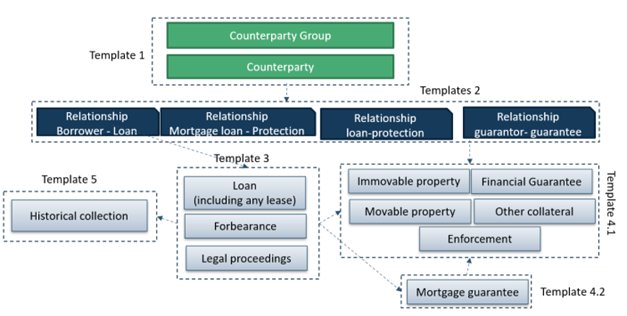

The following diagram shows an overview of the structure of the data tapes, divided into the following five templates:

- Counterparty (Template 1)

- Relationship (Templates 2.1; 2.2; 2.3; 2.4)

- Loan (Template 3)

- Collateral, guarantee and enforcement (Template 4.1 and 4.2).

- Historical collection of repayments (Template 5)

Source: EBA

GAP Analysis Highlights Similarities Between Reporting Regimes

With the goal of supporting its clients in the timely implementation of EBA’s new templates, European DataWarehouse (EDW) performed a preliminary GAP Analysis in July 2022, highlighting the key similarities between the ESMA templates for the provision of information on NPL exposures and the new proposed EBA templates.

Following the recent release of EBA’s final report, EDW has updated this GAP analysis: 2022 EBA NPL Template GAP Analysis (Version 2.0) as of January 2023.

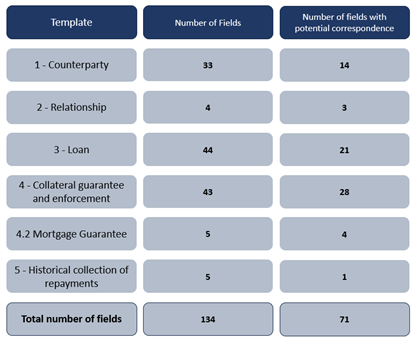

As shown in the table below, the final data tapes contain 134 fields, of which 74 are mandatory. Furthermore, 71 potential correspondences between ESMA and EBA templates were identified.

Source: EDW calculations as of January 2023

Among a number of improvements made from EBA, with a view of further simplifying the template and facilitating the provision of data for NPL transactions, EBA removed the “No data option” approach. Additionally, EBA removed the differentiation of mandatory/non-mandatory fields depending on the size of the loan (previously set at €25.000).

EDW to support NPL sellers in complying with the new EBA standards

EDW supports the roll-out of EBA’s templates and plans to implement a solution that will facilitate the disclosure of information on NPL portfolios based on the new proposed set of data tapes.

By implementing the NPL templates in its private area, sellers reporting to EDW will benefit from streamlined data submissions and EDW’s unparalleled experience in data quality management. The resulting superior data quality and remediation will enable investors to access the relevant information with confidence.

EDW gathered industry experts for a webinar on 31 January 2023 to discuss the new templates, their implementation and scope, and what impact they’ll have on the market in 2023 and beyond. To download the slides or watch the recording, featuring a keynote presentation from EBA’s Oleg Shmeljov & Lidja Schiavo, click below.

For further information and for the complete EDW NPL GAP Analysis Version 2.0 as of January 2023, please email enquiries@eurodw.eu