What it takes to have the “Best Data Quality” of the Year (and Decade)

European DataWarehouse launched its inaugural data quality award at the company’s 10-year anniversary celebration in November. This year EDW presented two awards; one for Data Quality of the Decade (2012-2022), awarded to Europea de Titulización S.A. (EDT) and one for Best Data Quality – Deal of the Year (2021-2022), which was awarded to Intesa San Paolo for their deal, Intesa San Paolo – BRERA Sec S.r.l. – RMBS 2021.

10 YEARS OF OUTSTANDING DATA QUALITY

In order to select the issuer with the best Data Quality of the Decade, EDW’s data analysts first narrowed down the candidates to a pool of issuers with at least 6 years of data submissions. From this list, we considered the Data Quality Score (DQS) obtained in each data submission (click to find out everything you need to know about EDW’s data quality scoring) and assigned a point according to the following logic:

A = 1 point

B = 2 points

C = 3 points

D = 4 points

E = 5 points

F = 6 points

The average score per data owner was then calculated and the issuer with the lowest score was identified. In this case, EDT, with a score of just 1.19 points was the clear winner.

DEAL OF THE YEAR FOR 2021-2022 AND BEYOND

A similar methodology was used to calculate EDW’s “Best Data Quality – Deal of the Year”. For this award only deals without any DQS rule failures were considered. These failures would have included flaws such as inappropriate use of ND5 or inconsistencies between fields.

To select a winner, the sum of the number of fails for each Data Quality Plus rule was divided by the total number of loans to find the deal with the lowest score. Data Quality Plus rules are more nuanced and include rules such as excessive usage of the “Other” option or duplicate/ negative values.

For the Intesa San Paolo – BRERA Sec S.r.l. – RMBS 2021 deal, the calculation looked like this:

- Sum of the number of fails for Data Quality Plus rules: 548

- Divided by the total number of loans: 61,499

- Calculated the deal with the lowest score: 0.0089

EDW’S COMMITMENT TO BETTER DATA QUALITY

With the introduction of the Securitisation Regulation (EU) 2017/2402 (SECR) EDW recognised the need to introduce data quality scoring on a deal level in 2017 and since then has developed and applied more than 4,000 rules and checks to both the ECB Loan-Level Data templates and the ESMA Underlying Exposures, Investor Report, and Significant Event templates.

EDW noted a measurable decrease in data quality as issuers faced the challenges associated with the evolving disclosure framework and incoming reporting format. As such, we have been supporting our clients in resolving their data quality issues and working together with them to achieve greater standardisation and transparency for the market.

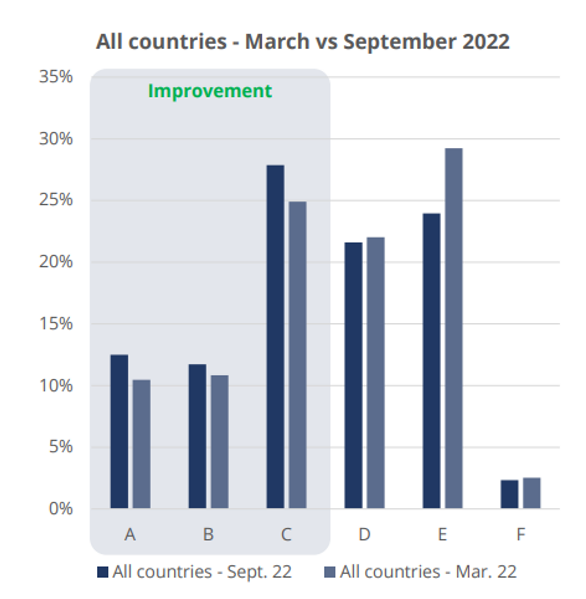

A recent analysis of the DQS distribution for all European deals within EDW’s EDITOR platform shows that the trend for better data quality is on the rise and we are committed to continuing our efforts in this area with those clients who share our mission.

THE NEXT AWARD GOES TO….

Starting in 2023, the Annual Data Quality Award will be presented at the TSI Congress in Berlin. As one of the European securitisation industry’s most important events, the TSI Congress is a natural setting for the award to be presented, and EDW is pleased to now have an annual platform that recognizes those who share our values and dedication to data quality.

To see how your deal’s data quality compares to its peers, and to improve your team’s data quality, login to EDITOR or read more about how the latest features in EDITOR NextGen gives issuers unparalleled insights into their data, with instant benchmarks and auto-generated deal reports.